Understanding the Process of Filing Business Taxes Online

Managing your business taxes can be a daunting task, especially if you’re new to the process. However, with the advent of online tax filing services, it has become easier than ever to handle your business tax obligations. In this article, we will delve into the details of filing business taxes online, covering various aspects to ensure you have a comprehensive understanding of the process.

Choosing the Right Online Tax Filing Service

When it comes to filing business taxes online, selecting the right service is crucial. There are numerous options available, each with its own set of features and pricing structures. To make an informed decision, consider the following factors:

- Compatibility with Your Business Structure: Ensure that the online tax filing service supports the specific legal structure of your business, whether it’s a sole proprietorship, partnership, corporation, or LLC.

- Features and Ease of Use: Look for a service that offers a user-friendly interface, comprehensive guidance, and access to various forms and schedules relevant to your business.

- Customer Support: Check if the service provides reliable customer support, including live chat, email, and phone assistance.

- Security and Privacy: Ensure that the service adheres to strict security measures to protect your sensitive financial information.

- Cost and Pricing Structure: Compare the costs of different services, including setup fees, filing fees, and any additional charges for premium features.

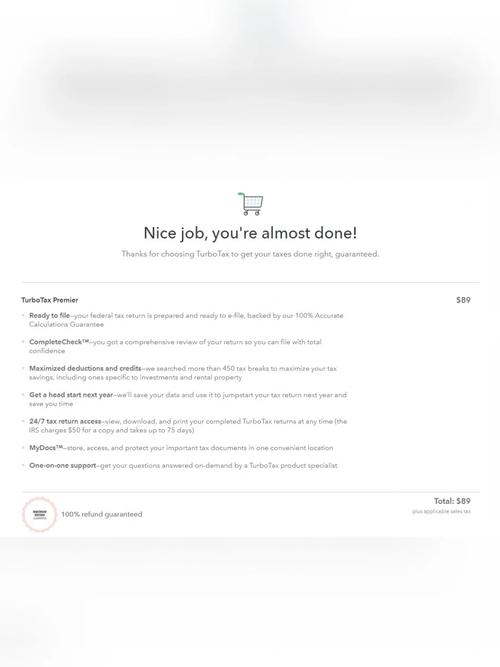

Some popular online tax filing services for businesses include TurboTax Business, H&R Block Tax Pro, and QuickBooks Self-Employed.

Understanding the Tax Forms and Deadlines

Before diving into the online tax filing process, it’s essential to familiarize yourself with the relevant tax forms and deadlines. Here’s a breakdown of some common forms and their corresponding deadlines:

| Form | Description | Deadline |

|---|---|---|

| Form 1120 | Corporate Income Tax Return | March 15th (for calendar year filers) |

| Form 1120S | Income Tax Return for an S Corporation | March 15th (for calendar year filers) |

| Form 1065 | U.S. Return of Partnership Income | April 15th (for calendar year filers) |

| Form 940 | Employer’s Annual Federal Unemployment (FUTA) Tax Return | January 31st |

| Form 941 | Employer’s Quarterly Tax Return | April 30th, July 31st, October 31st, and January 31st |

Remember that deadlines may vary depending on your business’s fiscal year. It’s crucial to stay organized and keep track of these deadlines to avoid penalties and interest.

Collecting and Organizing Your Business Tax Documents

Before you begin the online tax filing process, gather and organize all the necessary documents. This will help ensure a smooth and accurate filing experience. Here’s a list of common documents you’ll need:

- Financial Statements: Income statements, balance sheets, and cash flow statements for the tax year.

- Bank Statements: To verify income and expenses.

- Payroll Records: W-2s, 1099s, and other payroll-related documents.

- Receipts and Invoices: To substantiate deductions and expenses.

- Previous Tax Returns: For reference and comparison purposes.

Organize these documents in a systematic manner, either physically or digitally, to make the process more manageable.

Completing the Online Tax Filing Process

Once you have chosen an online tax filing service, gathered all the necessary documents