Transaction Files in a Brokerage Firm Must Contain

Managing transaction files is a critical aspect of operations in a brokerage firm. These files are not just a record of financial activities but also a reflection of the firm’s compliance with regulatory standards and internal policies. In this detailed guide, we will explore the essential elements that transaction files in a brokerage firm must contain, ensuring accuracy, transparency, and regulatory adherence.

Personal Identifiable Information (PII)

Transaction files must include personal identifiable information (PII) for all parties involved in the transaction. This typically includes the names, addresses, and identification numbers of the clients, as well as the brokerage firm’s own details. PII is crucial for tracking and verifying the identities of all parties, which is essential for regulatory compliance and fraud prevention.

| PII Elements | Description |

|---|---|

| Client Name | Full legal name of the client |

| Client Address | Physical address where the client resides |

| Client ID | Unique identifier issued to the client by the brokerage firm |

| Brokerage Firm Name | Name of the brokerage firm handling the transaction |

| Brokerage Firm ID | Unique identifier for the brokerage firm |

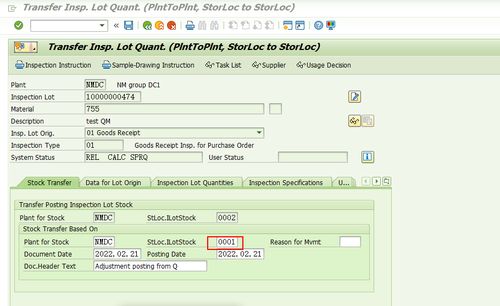

Transaction Details

Every transaction file must contain comprehensive details about the transaction itself. This includes the type of transaction, the assets involved, the date and time of the transaction, and the price at which the transaction was executed. These details are vital for accurate record-keeping and for regulatory audits.

Here’s a breakdown of the key transaction details:

- Type of Transaction: Whether it’s a buy, sell, or other type of financial transaction.

- Assets Involved: Specific details about the financial instruments or assets that were bought or sold.

- Date and Time: The exact date and time when the transaction was executed.

- Price: The price at which the transaction was executed.

- Transaction ID: A unique identifier for the transaction.

Counterparty Information

Transaction files must also include information about the counterparty involved in the transaction. This includes the counterparty’s name, address, and identification details. This information is important for tracking the transaction and for regulatory reporting purposes.

Compliance and Regulatory Information

Compliance with regulatory standards is paramount in the brokerage industry. Transaction files must contain information about the regulatory framework under which the transaction was executed, as well as any relevant compliance documentation. This includes, but is not limited to, anti-money laundering (AML) checks, know your customer (KYC) procedures, and transaction monitoring reports.

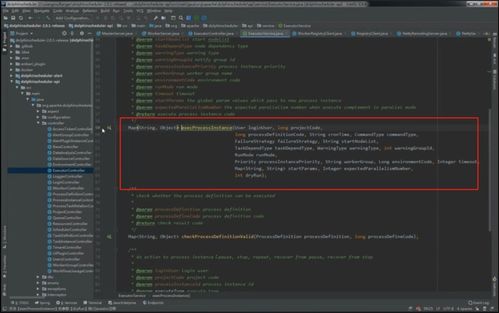

Internal Controls and Policies

Brokerage firms have internal controls and policies in place to ensure the integrity of their operations. Transaction files must document these controls and policies, including any approvals required for the transaction, the authority of the individuals involved, and any exceptions to standard procedures.

Documentation of Communication

Communication between the brokerage firm and its clients is a critical part of the transaction process. Transaction files must contain a record of all relevant communications, including emails, phone calls, and meetings. This documentation is essential for transparency and for resolving any disputes that may arise.

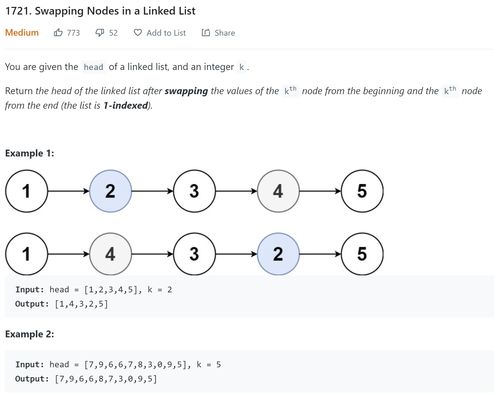

Consistency and Accuracy

Consistency and accuracy are key in transaction files. All information must be recorded in a clear, concise, and accurate manner. This includes using standardized formats for dates, times, and currency values, as well as ensuring that all entries are complete and up-to-date.

In conclusion, transaction files in a brokerage firm must contain a comprehensive set of information to ensure regulatory compliance, operational integrity, and client trust. By adhering to these guidelines, brokerage firms can maintain a robust and reliable record-keeping system that supports their business objectives and legal obligations.