Understanding Chapter 7 Bankruptcy

When considering filing for Chapter 7 bankruptcy, one of the most common questions that arise is, “How much debt do you need to file?” This article delves into the various aspects of this question, providing you with a comprehensive understanding of the debt requirements for filing Chapter 7 bankruptcy.

What is Chapter 7 Bankruptcy?

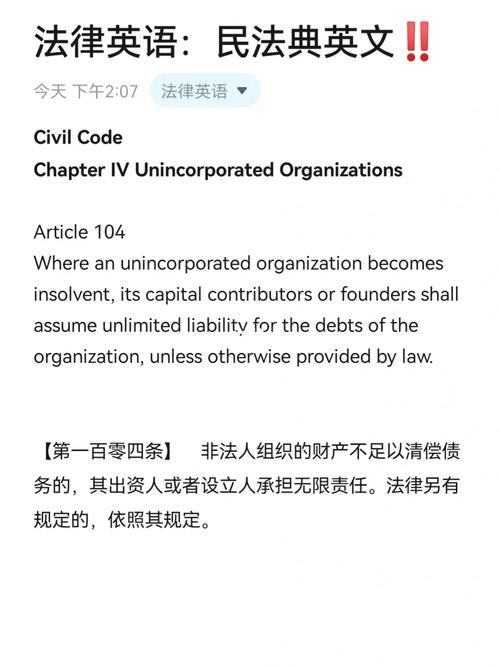

Chapter 7 bankruptcy is a form of bankruptcy that allows individuals to discharge most of their unsecured debts, such as credit card debt, medical bills, and personal loans. It is a liquidation bankruptcy, which means that the bankruptcy trustee will sell your non-exempt assets to pay off your creditors, and any remaining debt will be discharged.

Debt Requirements for Chapter 7 Bankruptcy

There is no specific dollar amount that you need to owe in order to file for Chapter 7 bankruptcy. However, there are certain debt requirements that you must meet:

-

Unsecured Debt: You must have a significant amount of unsecured debt, such as credit card debt, medical bills, and personal loans. Secured debts, such as mortgages and car loans, are not eligible for discharge in Chapter 7 bankruptcy.

-

Income: Your income must be below the median income for your state. If your income is above the median, you may still be eligible for Chapter 7 bankruptcy if you pass the “means test.” The means test evaluates your income, expenses, and assets to determine if you have the ability to repay a portion of your debt.

-

Exemptions: You must have enough exemptions to protect your assets from being sold by the bankruptcy trustee. Exemptions vary by state, so it is important to consult with a bankruptcy attorney to understand the exemptions available in your state.

How Much Debt is Considered Significant?

The amount of debt considered significant for Chapter 7 bankruptcy can vary depending on your individual circumstances. However, here are some general guidelines:

-

High Credit Card Debt: If you have a significant amount of credit card debt, you may be eligible for Chapter 7 bankruptcy. This is especially true if you have been unable to make minimum payments for an extended period of time.

-

Medical Bills: If you have accumulated a large amount of medical debt due to an unexpected illness or injury, you may be eligible for Chapter 7 bankruptcy. This is particularly true if you have no insurance or your insurance does not cover the full cost of your medical expenses.

-

Personal Loans: If you have taken out personal loans to cover living expenses or pay off other debts, you may be eligible for Chapter 7 bankruptcy. However, it is important to note that certain types of personal loans, such as student loans, are not eligible for discharge in Chapter 7 bankruptcy.

Table: Debt Requirements for Chapter 7 Bankruptcy

| Debt Type | Eligibility for Discharge |

|---|---|

| Credit Card Debt | Yes |

| Medical Bills | Yes |

| Personal Loans | Yes (except for student loans) |

| Secured Debts (e.g., mortgages, car loans) | No |

| Student Loans | No |

Factors to Consider Before Filing for Chapter 7 Bankruptcy

Before deciding to file for Chapter 7 bankruptcy, it is important to consider the following factors:

-

Asset Liquidation: Chapter 7 bankruptcy involves the liquidation of your non-exempt assets to pay off your creditors. If you have valuable assets that you wish to keep, you may need to consider other bankruptcy options, such as Chapter 13.

-

Impact on Credit Score: Filing for bankruptcy will have a negative impact on your credit score. However, it is important to note that your credit score will begin to improve as you pay off your remaining debts and rebuild your credit.