Last Date to File Taxes 2024: A Comprehensive Guide

As the year 2024 approaches, many individuals and businesses are preparing to file their taxes. Understanding the last date to file taxes is crucial to ensure compliance and avoid penalties. In this article, we will delve into the various aspects of the tax filing deadline, including extensions, penalties, and important dates to remember.

Understanding the Tax Filing Deadline

The last date to file taxes for most individuals and businesses in the United States is April 15, 2024. However, this date can change due to holidays or other circumstances. It is essential to stay informed about any changes that may occur.

What Happens if You Miss the Deadline?

Missing the tax filing deadline can result in penalties and interest charges. The penalties vary depending on the type of tax return and the reason for the late filing. For individuals, the penalty for filing late is typically 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. Additionally, interest will continue to accrue on the unpaid balance.

Extensions and Deadlines

If you are unable to file your taxes by the April 15, 2024 deadline, you may request an extension. The IRS offers automatic extensions of up to six months, which means you have until October 15, 2024, to file your return. To request an extension, you must file Form 4868 by April 15, 2024.

It is important to note that while an extension gives you more time to file your return, it does not give you more time to pay any taxes owed. If you expect to owe taxes, you should estimate the amount and pay it by April 15, 2024, to avoid penalties and interest.

Penalties for Late Payments

Even if you request an extension, you may still be subject to penalties for late payments. The penalty for late payment is typically 0.5% of the unpaid tax for each month or part of a month that the tax is unpaid, up to a maximum of 25% of the unpaid tax. Interest will also continue to accrue on the unpaid balance.

Important Dates to Remember

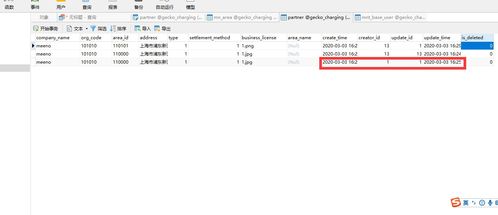

Here is a table summarizing the important dates related to tax filing for 2024:

| Date | Description |

|---|---|

| April 15, 2024 | Last day to file taxes without requesting an extension |

| April 15, 2024 | Last day to pay any taxes owed without incurring penalties |

| October 15, 2024 | Deadline to file taxes with an automatic extension |

Special Considerations for Certain Taxpayers

Some taxpayers may have different deadlines for filing their taxes. For example, taxpayers who live in Maine or Massachusetts have until April 17, 2024, to file their taxes due to the Patriots’ Day holiday. Additionally, taxpayers who are serving on active duty in a combat zone may have extended deadlines for filing and paying taxes.

Conclusion

Understanding the last date to file taxes for 2024 is crucial for individuals and businesses to ensure compliance and avoid penalties. By staying informed about deadlines, extensions, and penalties, you can navigate the tax filing process more effectively. Remember to file your taxes by April 15, 2024, or request an extension by that date to avoid any potential penalties and interest charges.