Understanding IRS e-File: A Comprehensive Guide for Taxpayers

When it comes to filing taxes, the IRS e-file option has become increasingly popular among taxpayers. This article aims to provide you with a detailed and multi-dimensional introduction to IRS e-file, covering its benefits, how it works, and what you need to know before you get started.

What is IRS e-file?

IRS e-file is an electronic tax filing system that allows taxpayers to submit their tax returns directly to the IRS through authorized tax professionals or tax software. It is a secure and efficient way to file taxes, offering numerous benefits over traditional paper filing methods.

Benefits of IRS e-file

One of the most significant advantages of IRS e-file is the speed of processing. Tax returns filed electronically are typically processed much faster than those filed on paper. This means you can receive your refund sooner, often within a few weeks.

Another benefit is the accuracy of e-filed returns. When you file your taxes online, the software can help you catch errors and omissions that might occur when filling out a paper return. This can help prevent audits and ensure that you are getting the maximum refund you are entitled to.

Additionally, IRS e-file is more convenient than paper filing. You can file your taxes from the comfort of your home, at any time of the day or night, as long as you have access to a computer and the internet.

How does IRS e-file work?

IRS e-file works by using tax software or a tax professional to prepare your tax return. Once your return is complete, it is submitted to the IRS through a secure connection. The IRS then processes the return and, if applicable, issues a refund.

There are several ways to e-file your taxes:

-

Using tax software: There are many tax software options available, such as TurboTax, H&R Block, and TaxAct. These programs guide you through the tax filing process and ensure that your return is accurate and complete.

-

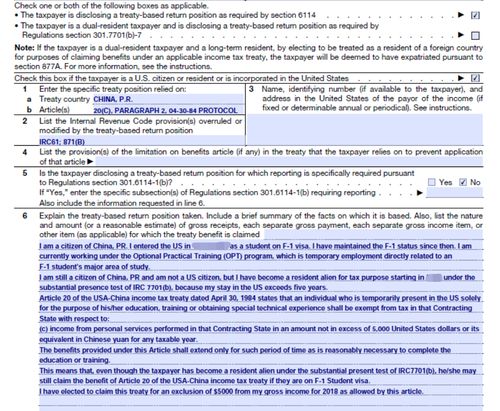

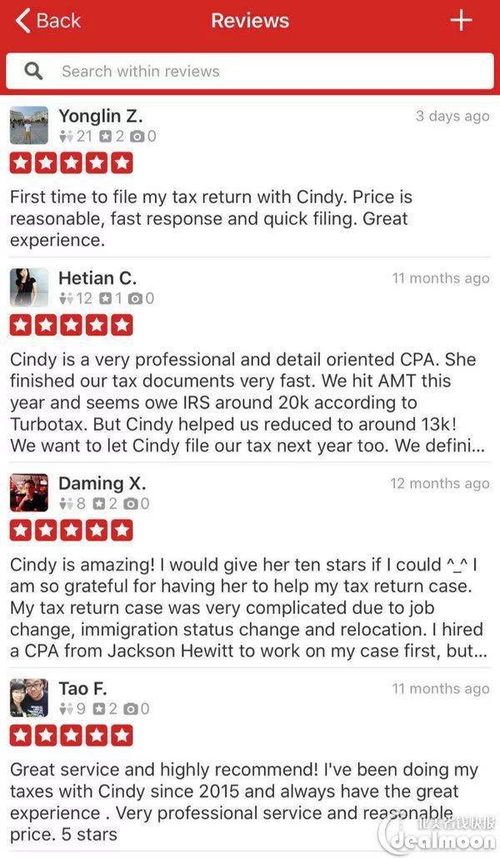

Using a tax professional: If you prefer to have a professional prepare your taxes, you can find an authorized e-file provider through the IRS website. These professionals are trained to use the e-file system and can help you navigate any complex tax situations.

-

Using a tax preparer: Some tax preparers are authorized to e-file on behalf of their clients. Be sure to ask your tax preparer if they offer e-file services.

What do I need to know before I e-file?

Before you e-file your taxes, there are a few things you should keep in mind:

-

Eligibility: Not all taxpayers are eligible to e-file. For example, if you are claiming the standard deduction, you may need to file a paper return. Check the IRS website to see if you are eligible to e-file.

-

Security: IRS e-file is a secure system, but it is important to protect your personal information. Use a strong password and keep your login information confidential.

-

Payment options: If you owe taxes, you can pay online through the IRS website or by using a credit card. Be sure to make your payment by the tax deadline to avoid penalties and interest.

-

Refund status: You can check the status of your refund online using the IRS’s “Where’s My Refund?” tool. This tool provides an estimated refund date based on the information you provided on your tax return.