File Tax Return Free: A Comprehensive Guide for You

Are you looking for ways to file your tax return without spending a dime? Filing your taxes for free can be a daunting task, but with the right information and resources, it can be a straightforward process. In this article, we will explore various methods and tools that can help you file your tax return for free. Let’s dive in!

Understanding Free Tax Filing Options

Before we delve into the specifics of filing your tax return for free, it’s essential to understand the different options available to you. Here are some of the most common free tax filing methods:

- Free File: This is a free tax filing service offered by the IRS for eligible taxpayers. It’s a great option if your income is below a certain threshold and you’re comfortable using online tax software.

- Free File Fillable Forms: This option allows you to file your tax return using the IRS’s fillable forms. It’s a good choice if you prefer paper forms and want to file your taxes for free.

- Volunteer Income Tax Assistance (VITA): This program offers free tax preparation services to eligible individuals. VITA volunteers are trained to help taxpayers with their tax returns.

- Tax Counseling for the Elderly (TCE): This program provides free tax preparation services to individuals aged 60 and older. TCE volunteers are trained to assist seniors with their tax returns.

Eligibility for Free Tax Filing

Not everyone is eligible for free tax filing. Here are some factors that determine your eligibility:

- Income Level: The IRS offers free tax filing services to individuals with an adjusted gross income (AGI) of $72,000 or less. If your income exceeds this threshold, you may still be eligible for free tax filing through certain tax software providers.

- Age and/or Disability: Certain programs, such as VITA and TCE, have age and/or disability requirements. For example, VITA is available to individuals aged 60 and older, while TCE is specifically designed for seniors.

- Residency: Some free tax filing services are only available to residents of specific states or regions.

Using Free File

Free File is a popular option for many taxpayers. Here’s how to use it:

- Visit the IRS’s Free File website at irs.gov/free-file.

- Select a tax software provider from the list of participating companies. Some popular options include H&R Block, TurboTax, and TaxAct.

- Enter your personal information and answer questions about your income, deductions, and credits.

- Review your tax return and submit it to the IRS.

Using Free File Fillable Forms

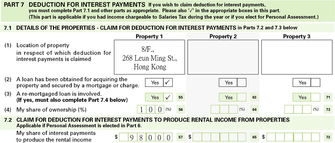

Free File Fillable Forms is another option for those who prefer paper forms. Here’s how to use it:

- Visit the IRS’s Free File Fillable Forms website at irs.gov/uac/free-file-fillable-forms.

- Select the tax year for which you want to file.

- Choose the form you need and start filling it out online.

- Print the completed form and mail it to the IRS.

Using VITA and TCE

Both VITA and TCE offer free tax preparation services. Here’s how to use these programs:

- VITA:

- Find a VITA site near you by visiting irs.gov/uac/vita-volunteer-income-tax-assistance.

- Make an appointment with a VITA volunteer.

- Bring all necessary documents, such as your tax returns from previous years, W-2s, and 1099s.

- Work with the volunteer to complete your tax return.

- TCE: