E-file: A Comprehensive Guide to Online Tax Filing

Are you tired of the hassle of paper tax returns? Do you want to save time and money on your taxes? E-filing is the solution you’ve been looking for. In this detailed guide, we’ll explore everything you need to know about e-filing, from the basics to the benefits and the process.

What is E-filing?

E-filing is the process of submitting your tax return electronically to the IRS or your state tax agency. It’s a convenient and secure way to file your taxes, and it’s become increasingly popular in recent years.

Benefits of E-filing

There are many benefits to e-filing your taxes, including:

| Benefit | Description |

|---|---|

| Speed | E-filing is faster than paper filing. You can get your refund in as little as 21 days. |

| Accuracy | E-filing reduces errors. The software checks your return for mistakes before you submit it. |

| Security | E-filing is secure. The IRS uses the latest encryption technology to protect your personal information. |

| Convenience | You can file your taxes from anywhere, at any time, as long as you have an internet connection. |

How to E-file

Here’s a step-by-step guide to e-filing your taxes:

-

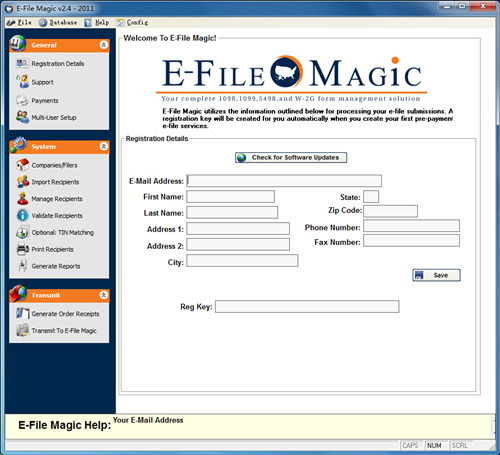

Choose an e-file provider. There are many reputable providers available, such as TurboTax, H&R Block, and TaxAct.

-

Collect your tax documents. This includes your W-2s, 1099s, and any other tax forms you need.

-

Enter your information into the e-file provider’s software. The software will guide you through the process and help you complete your return.

-

Review your return. Make sure all the information is correct before you submit it.

-

Submit your return. Once you’re ready, you can submit your return directly to the IRS or your state tax agency.

Types of E-filing

There are two main types of e-filing: self-prepared and prepared.

-

Self-prepared e-filing. This is when you prepare your own tax return using e-file software. There are many free and paid options available.

-

Prepared e-filing. This is when you have a tax professional prepare your return for you and then e-file it on your behalf.

Common E-filing Mistakes

While e-filing is generally straightforward, there are some common mistakes to avoid:

-

Not double-checking your information. Make sure all the information on your return is accurate.

-

Not choosing the right filing status. Make sure you choose the filing status that best fits your situation.

-

Not claiming all the deductions and credits you’re eligible for. Take the time to review all the deductions and credits you can claim.

Is E-filing Safe?

E-filing is safe, but it’s important to take precautions to protect your personal information. Here are some tips:

-

Use a reputable e-file provider.

-

Use a secure internet connection.

-

Keep your login information secure.

Conclusion

E-filing is a convenient, accurate, and secure way to file your taxes. By following these tips and using a reputable e-file provider, you can ensure a smooth and successful tax filing experience.