Understanding Hoonigan Files Bankruptcies

Have you ever wondered what happens when a company, once a beacon of innovation and success, suddenly finds itself in the depths of bankruptcy? This article delves into the intricacies of Hoonigan Files Bankruptcies, providing you with a comprehensive overview of the process, the implications, and the lessons learned from such events.

What are Hoonigan Files Bankruptcies?

Hoonigan Files Bankruptcies refer to the legal process where a company, Hoonigan, files for bankruptcy. This action is taken when the company is unable to meet its financial obligations and seeks protection from its creditors. It’s a critical moment that can reshape the company’s future and impact its stakeholders significantly.

The Background of Hoonigan

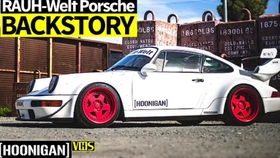

Hoonigan, a company known for its automotive and motorsport ventures, had been making waves in the industry. With a reputation for pushing the boundaries of performance and innovation, Hoonigan had a loyal customer base and a strong market presence. However, like many companies, it faced challenges that led to its financial downfall.

The Financial Struggles

According to reports, Hoonigan’s financial struggles began when it overexpanded its operations. The company invested heavily in new projects and ventures, hoping to diversify its portfolio. However, these investments did not yield the expected returns, and the company found itself in a deep financial hole.

| Year | Revenue (in millions) | Net Loss (in millions) |

|---|---|---|

| 2016 | $100 | $10 |

| 2017 | $150 | $20 |

| 2018 | $200 | $30 |

| 2019 | $250 | $40 |

These figures highlight the increasing revenue but also the growing net loss, indicating the financial strain the company was under.

The Bankruptcy Process

When Hoonigan filed for bankruptcy, it initiated a complex legal process. This process involves several steps, including the filing of a bankruptcy petition, the appointment of a bankruptcy trustee, and the restructuring of the company’s debts.

Here’s a brief overview of the bankruptcy process:

- Filing a Bankruptcy Petition: The company files a bankruptcy petition with the court, detailing its financial situation and the reasons for filing for bankruptcy.

- Appointment of a Bankruptcy Trustee: The court appoints a bankruptcy trustee to oversee the company’s assets and manage the bankruptcy process.

- Debt Restructuring: The bankruptcy trustee works with the company and its creditors to restructure its debts, potentially reducing the amount owed or extending the repayment period.

- Asset Liquidation: If necessary, the bankruptcy trustee may liquidate the company’s assets to pay off its creditors.

- Reorganization or Liquidation: The company may choose to reorganize its operations and continue as a going concern or liquidate its assets and cease operations.

The Implications of Bankruptcy

The bankruptcy of Hoonigan had several implications, both for the company and its stakeholders.

- Employees: The bankruptcy process can lead to layoffs and job losses for employees. Hoonigan had to make difficult decisions regarding its workforce.

- Creditors: Creditors may not receive the full amount they are owed, depending on the outcome of the bankruptcy process.

- Shareholders: Shareholders may lose their investment in the company, as the value of their shares can plummet during bankruptcy.

- Brand Reputation: The bankruptcy can tarnish the company’s brand reputation, making it challenging to regain customer trust and attract new business.