Understanding the Process of Filing a VA Claim: A Comprehensive Guide for You

When you’ve served your country with honor and dedication, it’s only fair that you receive the support you deserve. One of the ways the United States acknowledges and compensates veterans for their service is through the VA claim process. If you’re a veteran or a family member of a veteran, understanding how to file a VA claim is crucial. This guide will walk you through the entire process, from eligibility to the final decision, ensuring you’re well-prepared for each step.

Eligibility for VA Claims

Before you can file a VA claim, it’s important to determine if you’re eligible. The Department of Veterans Affairs (VA) has specific criteria that must be met. Here’s what you need to know:

| Eligibility Criteria | Description |

|---|---|

| Service in the Armed Forces | You must have served in the active military, naval, or air service, or have been a member of the National Guard or Reserves, and been called to active duty. |

| Discharge Status | Your discharge must have been under other than dishonorable conditions. |

| Service-Connected Disability | Your disability must be the result of your military service. |

These are the basic requirements, but there are many exceptions and nuances. It’s best to consult the VA’s official website or a veterans service organization for detailed information about your specific situation.

Types of VA Claims

VA claims can be categorized into several types, each serving a different purpose. Here’s an overview:

- Service-Connected Disability Claims: These claims are for disabilities that are related to your military service. They can be for a single condition or multiple conditions.

- Non-Service-Connected Disability Claims: These claims are for disabilities that are not related to military service but are deemed disabling.

- Survivor’s Benefits: These claims are for surviving family members of veterans who have passed away.

- Home Loan Guaranty: This is a benefit that helps veterans purchase homes with favorable terms.

- Life Insurance: The VA offers life insurance policies to veterans and their families.

Understanding the type of claim you need to file is the first step in the process. Be sure to research which category your situation falls into.

How to File a VA Claim

Filing a VA claim can be done in several ways, each with its own set of advantages and disadvantages. Here are the most common methods:

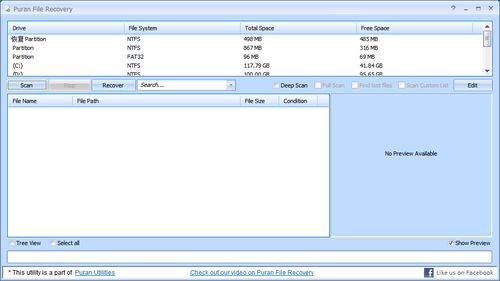

- Online: The VA’s eBenefits portal allows you to file a claim online. This is the fastest and most convenient method, as you can submit your claim from the comfort of your home.

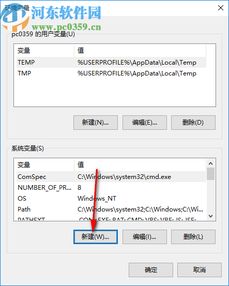

- By Mail: You can download the necessary forms from the VA’s website and mail them in. This method is slower but can be more suitable for those who prefer paper forms.

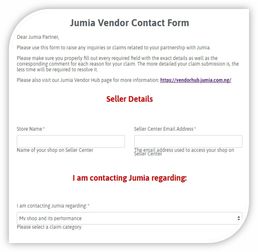

- In Person: You can visit your local VA office to file a claim. This method is beneficial if you need assistance or have questions about the process.

When filing your claim, be sure to include all necessary documentation, such as medical records, discharge papers, and any other relevant information. The VA will use this documentation to determine your eligibility and the extent of your benefits.

The VA Claim Process

The VA claim process can be lengthy, often taking several months to complete. Here’s a general overview of what to expect:

- Initial Submission: You submit your claim, along with all required documentation.

- Initial Review: The VA reviews your claim and determines if it’s complete. If not, they may request additional information.

- Decision: The VA makes a decision on your claim. This decision can be a grant, a denial, or a remand for additional information.

- Appeal: If you’re not satisfied with the VA’s decision, you have the right