Understanding the Tax File Deadline 2024: A Comprehensive Guide for You

As the year 2024 approaches, it’s crucial for individuals and businesses to be aware of the tax file deadline. This deadline is a significant date on the calendar for anyone who needs to submit their tax returns or make necessary adjustments to their tax affairs. In this article, we will delve into the details of the tax file deadline 2024, providing you with a comprehensive guide to ensure you’re fully prepared.

What is the Tax File Deadline?

The tax file deadline is the final date by which individuals and businesses must submit their tax returns or make adjustments to their tax affairs. This deadline is set by the tax authority in each country and is crucial for ensuring that everyone complies with their tax obligations. Failure to meet this deadline can result in penalties and interest charges, so it’s essential to be aware of the specific date for 2024.

Understanding the Tax File Deadline 2024

The tax file deadline for 2024 is set to be on [Insert Date]. This date is the last opportunity for individuals and businesses to submit their tax returns or make adjustments to their tax affairs for the previous financial year. It’s important to note that this deadline is not the same as the tax payment deadline, which is typically a separate date.

Who Needs to Submit a Tax Return by the Deadline?

Not everyone is required to submit a tax return, but there are certain groups of individuals and businesses who must do so by the tax file deadline. These include:

| Individuals | Businesses |

|---|---|

| Self-employed individuals | Small businesses with an annual turnover of over $75,000 |

| Individuals with income from multiple sources | Companies with a financial year-end that falls within the tax year |

| Trustees of trusts with income over a certain threshold | Partnerships with a net income over a certain threshold |

It’s important to check if you fall into one of these categories, as failure to submit a tax return by the deadline can result in penalties and interest charges.

How to Prepare for the Tax File Deadline 2024

Preparing for the tax file deadline involves several steps to ensure that you’re ready to submit your tax return or make necessary adjustments. Here’s a guide to help you get started:

-

Organize your financial records: Gather all your income statements, receipts, and other relevant documents for the previous financial year. This will help you accurately complete your tax return.

-

Understand your tax obligations: Familiarize yourself with the tax laws and regulations in your country. This will help you determine if you need to submit a tax return and what information you need to include.

-

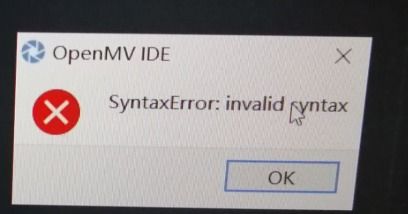

Use tax software or seek professional help: If you’re not confident in completing your tax return, consider using tax software or seeking the assistance of a tax professional. They can help ensure that your return is accurate and submitted on time.

-

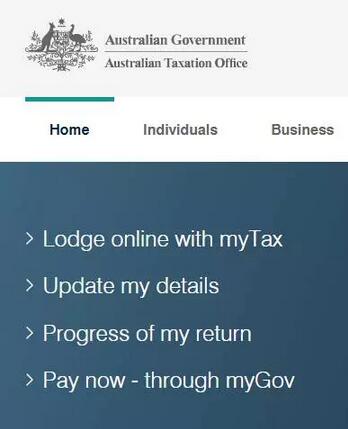

Submit your tax return: Once you have all the necessary information, submit your tax return by the deadline. You can do this online, by post, or in person, depending on your country’s tax authority requirements.

What to Do if You Miss the Tax File Deadline 2024

Despite your best efforts, you may still miss the tax file deadline. If this happens, here are some steps you can take:

-

Contact your tax authority: As soon as you realize you’ve missed the deadline, contact your tax authority. They can provide you with guidance on how to rectify the situation and may offer an extension or penalty relief.

-

Submit your tax return as soon as possible: Even if you’ve missed the deadline, it’s important to submit your tax return as soon as possible. This will help minimize any penalties and interest charges.

-

Consider seeking professional help: If you’re unsure about how to proceed, consider seeking the assistance of a tax professional. They can help you navigate the process and ensure that you comply with all tax obligations.