Understanding the Concept of Filing a Claim

Filing a claim is a process that many individuals and businesses encounter at some point in their lives. Whether it’s due to a faulty product, a service that didn’t meet expectations, or an insurance-related issue, understanding the ins and outs of filing a claim is crucial. In this article, we will delve into the details of what it means to file a claim, the reasons behind doing so, and the steps involved in the process.

What is a Claim?

A claim is a formal request made by an individual or entity to receive compensation or reimbursement for a loss, damage, or injury. This can be in the form of insurance claims, warranty claims, or even legal claims. The purpose of filing a claim is to seek financial or other forms of compensation for the inconvenience or harm suffered.

Reasons to File a Claim

There are various reasons why someone might need to file a claim. Here are some common scenarios:

| Scenario | Reason for Filing a Claim |

|---|---|

| Insurance-related incidents | To receive compensation for damages or medical expenses covered by the insurance policy. |

| Defective products | To seek a refund, replacement, or repair for a product that is found to be faulty or unsafe. |

| Service-related issues | To request a refund or compensation for a service that did not meet the agreed-upon standards. |

| Legal disputes | To seek justice and compensation for damages caused by another party’s actions or negligence. |

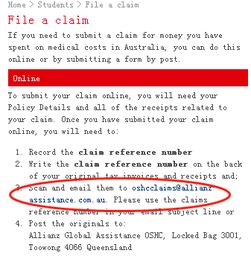

Steps to File a Claim

When it comes to filing a claim, there are several steps you need to follow to ensure a smooth process. Here’s a general outline:

-

Identify the issue: Determine the nature of the problem and whether it qualifies as a valid claim.

-

Review the terms and conditions: Understand the policy or agreement that governs the claim, including any limitations or exclusions.

-

Collect evidence: Gather all relevant documentation, such as receipts, invoices, photographs, or witness statements.

-

Contact the appropriate party: Reach out to the insurance company, manufacturer, service provider, or legal representative to initiate the claim.

-

Complete the claim form: Fill out the necessary forms accurately and provide all required information.

-

Submit the claim: Send the completed form and supporting documents to the appropriate party.

-

Follow up: Keep track of the claim’s progress and follow up with the relevant party if necessary.

Common Challenges in Filing a Claim

While filing a claim is generally straightforward, there are some common challenges that individuals and businesses may encounter:

-

Complex claim forms: Some claim forms can be lengthy and confusing, requiring careful attention to detail.

-

Denials: Claims may be denied for various reasons, such as incomplete documentation or a lack of coverage.

-

Delays: The claim process can sometimes be lengthy, leading to frustration and uncertainty.

-

Disputes: Disagreements may arise between the claimant and the party responsible for the claim, requiring mediation or legal intervention.

Seeking Professional Help

In some cases, it may be beneficial to seek professional help when filing a claim. Here are a few scenarios where professional assistance can be valuable:

-

Complex claims: If the claim is complex or involves a significant amount of money, consulting with a lawyer or an insurance claims adjuster can be helpful.

-

Disputes: If there is a disagreement between the claimant and the party responsible for the claim, a mediator or arbitrator may be needed.

-

Insurance-related issues: A professional can help navigate the complexities of insurance policies and ensure that the claim is handled correctly.