How to File BOI Report: A Comprehensive Guide

Understanding the Business Ownership Identification (BOI) report is crucial for any entrepreneur or business owner. This guide will walk you through the process of filing a BOI report, ensuring that you are well-prepared and informed every step of the way.

What is a BOI Report?

A Business Ownership Identification (BOI) report is a document that provides detailed information about the ownership structure of a business. It is typically required by government agencies and financial institutions to ensure compliance with regulations and to prevent money laundering and other financial crimes.

Why is a BOI Report Important?

There are several reasons why filing a BOI report is important:

-

Compliance with regulations: Filing a BOI report helps ensure that your business is in compliance with anti-money laundering and counter-terrorism financing laws.

-

Access to financing: Financial institutions may require a BOI report before approving loans or other forms of financing.

-

Transparency: A BOI report promotes transparency in your business’s ownership structure, which can enhance your reputation and credibility.

Step-by-Step Guide to Filing a BOI Report

Follow these steps to file a BOI report:

-

Collect the necessary information:

-

Legal name of the business

-

Trade name (if applicable)

-

Business address

-

Principal business activity

-

Legal form of business (e.g., sole proprietorship, partnership, corporation)

-

Names and details of all owners and beneficial owners

-

Percentage of ownership for each owner

-

-

Complete the BOI report form:

-

Download the BOI report form from the appropriate government agency’s website.

-

Fill in all required information accurately and completely.

-

Ensure that you sign and date the form.

-

-

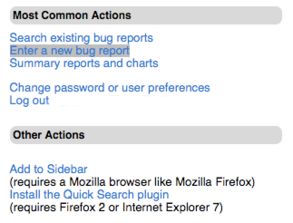

Submit the BOI report:

-

Submit the completed BOI report to the appropriate government agency, either online or by mail.

-

Some agencies may require additional documentation, such as proof of identity or business registration.

-

-

Keep a copy for your records:

-

Make a copy of the completed BOI report for your records.

-

This will be useful for future reference and compliance purposes.

-

Common Mistakes to Avoid When Filing a BOI Report

Here are some common mistakes to avoid when filing a BOI report:

-

Not providing complete information: Ensure that you provide all required information on the BOI report form.

-

Not verifying the accuracy of the information: Double-check the information you provide to ensure its accuracy.

-

Not submitting the report on time: Be aware of the deadline for submitting the BOI report and submit it on time to avoid penalties.

-

Not keeping a copy of the report: Always keep a copy of the completed BOI report for your records.

Additional Resources

Here are some additional resources that may help you with the BOI report filing process:

-

Government agency websites: Visit the website of the appropriate government agency for information on BOI reporting requirements and forms.

-

Financial institutions: Contact your financial institution for guidance on BOI reporting requirements and how it may affect your financing options.

-

Legal professionals: Consider consulting with a legal professional for advice on BOI reporting and compliance issues.

Conclusion

Filing a BOI report is an important step in ensuring compliance with