Understanding IRS.gov Free File: A Comprehensive Guide for You

Are you looking to file your taxes without breaking the bank? IRS.gov Free File is a valuable resource that can help you do just that. In this detailed guide, we’ll explore what IRS.gov Free File is, how it works, and the benefits it offers. Whether you’re a first-time filer or a seasoned tax preparer, this guide will provide you with all the information you need to make the most of this free service.

What is IRS.gov Free File?

IRS.gov Free File is a free tax filing service offered by the Internal Revenue Service (IRS) in partnership with private tax software companies. This service is designed to help eligible taxpayers file their federal tax returns for free. It’s an excellent option for those who have a simple tax situation or who earn a low to moderate income.

How Does IRS.gov Free File Work?

Using IRS.gov Free File is a straightforward process. Here’s a step-by-step guide to help you navigate the service:

-

Visit the IRS.gov Free File website.

-

Select a tax software provider that offers free filing for your situation.

-

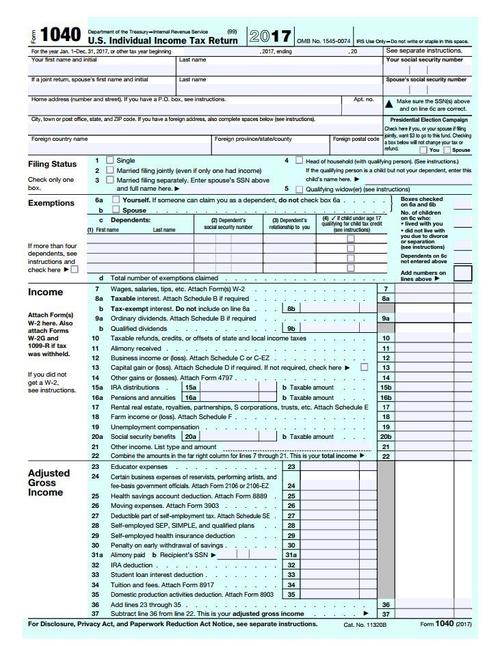

Enter your personal information and tax details.

-

Review and submit your tax return.

It’s important to note that not all tax software providers offer free filing through IRS.gov Free File. To find a provider that suits your needs, you can use the IRS’s “Find a Free File Provider” tool on the IRS.gov Free File website.

Who is Eligible for IRS.gov Free File?

Eligibility for IRS.gov Free File depends on your income and your filing status. Here’s a breakdown of the eligibility criteria:

| Income Level | Filing Status |

|---|---|

| $72,000 or less | Single, Head of Household, or Married Filing Jointly |

| $50,000 or less | Married Filing Separately |

| $66,000 or less | Qualifying Widow(er) with Dependent Child |

Additionally, certain tax software providers may offer free filing to taxpayers with disabilities or those who are unable to use a computer.

Benefits of Using IRS.gov Free File

There are several benefits to using IRS.gov Free File:

-

Save Money: The most obvious benefit is that you can file your taxes for free, which can save you hundreds of dollars in tax preparation fees.

-

Accuracy: Many tax software providers offer features that help ensure your tax return is accurate and complete.

-

Security: IRS.gov Free File is a secure platform that protects your personal and financial information.

-

Support: Tax software providers typically offer customer support to help you with any questions or issues you may encounter.

Common Questions About IRS.gov Free File

Here are some common questions about IRS.gov Free File, along with their answers:

-

Question: Can I file my state taxes for free through IRS.gov Free File?

Answer: Some tax software providers offer free state tax filing with their federal tax filing service. Check with your chosen provider to see if this is available.

-

Question: Can I file my taxes for free if I’m self-employed?

Answer: Some tax software providers offer free filing for self-employed individuals, but it depends on the provider and your specific tax situation.

-

Question: Can I file my taxes for free if I owe money to the IRS?

Answer: Yes, you can still file your taxes for free through IRS.gov Free File, even if you owe money to the IRS.