When Should I File TAP Compliance at Baruch?

Understanding the Tax Allocation Program (TAP) compliance requirements at Baruch College is crucial for students and staff alike. TAP is a program designed to help students manage their tax obligations while attending college. Filing TAP compliance at the right time can save you from potential penalties and ensure a smooth financial aid process. Let’s delve into the details to help you determine when you should file TAP compliance at Baruch.

What is TAP Compliance?

TAP compliance refers to the process of adhering to the Tax Allocation Program’s regulations. This program is specifically designed for students who are residents of New York State and are attending an institution of higher education in New York. The primary goal of TAP is to provide financial assistance to eligible students to help them cover the cost of their education.

Eligibility for TAP Compliance

Before determining when to file TAP compliance, it’s essential to understand the eligibility criteria. To be eligible for TAP, you must:

- Be a New York State resident.

- Be enrolled in an approved program of study.

- Be a U.S. citizen or eligible non-citizen.

- Not have an outstanding debt to New York State for a previous award year.

Ensure that you meet these criteria before proceeding with the TAP compliance process.

When to File TAP Compliance

Now that you understand the eligibility requirements, let’s discuss the timeline for filing TAP compliance at Baruch College.

Initial Filing

For new students, the initial filing for TAP compliance should be done within 30 days of the start of the semester. This ensures that your financial aid package is processed promptly and that you receive the necessary funds to cover your educational expenses.

Annual Renewal

Current students must renew their TAP compliance annually. The renewal process typically begins in early spring, and the deadline is usually in early June. It’s crucial to complete the renewal process before the deadline to avoid any delays in receiving your financial aid.

Special Circumstances

In certain situations, you may need to file TAP compliance outside the regular timeline. Here are some examples:

-

Change in residency status: If you change your residency status, you must notify the financial aid office and file a new TAP application.

-

Change in enrollment status: If you change your enrollment status (e.g., from full-time to part-time), you must notify the financial aid office and update your TAP application accordingly.

-

Change in program of study: If you change your program of study, you must notify the financial aid office and update your TAP application.

Always keep the financial aid office informed of any changes that may affect your TAP compliance status.

How to File TAP Compliance

Filing TAP compliance at Baruch College is a straightforward process. Here’s a step-by-step guide:

-

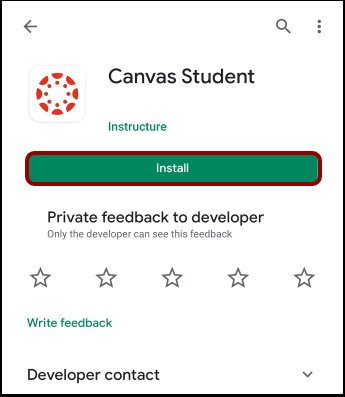

Log in to your CUNYfirst account.

-

Go to the “Financial Aid” section.

-

Select “TAP Application” and follow the instructions.

-

Complete the application and submit any required documentation.

-

Review your application status and make any necessary updates.

For detailed instructions and assistance, visit the Baruch College financial aid website or contact the financial aid office directly.

Benefits of Timely TAP Compliance

By filing TAP compliance at the right time, you can enjoy several benefits:

-

Receive your financial aid package promptly.

-

Avoid potential penalties and late fees.

-

Ensure a smooth financial aid process.

Timely TAP compliance is essential for a successful college experience.

Conclusion

Understanding when to file TAP compliance at Baruch College is crucial for managing your financial aid effectively. By adhering to the eligibility criteria, following the proper timeline, and staying informed about any changes, you can ensure a seamless financial aid process. Always keep the financial aid office updated on any changes that