Fincen Boy Reporting E-file Document Line 38: A Detailed Multi-dimensional Guide

Understanding the intricacies of financial reporting can be a daunting task, especially when it comes to specific lines within documents like the Fincen Boy Reporting E-file. One such critical line is line 38, which requires a detailed examination from various angles. Let’s delve into what this line entails and how it impacts financial reporting.

What is Fincen Boy Reporting?

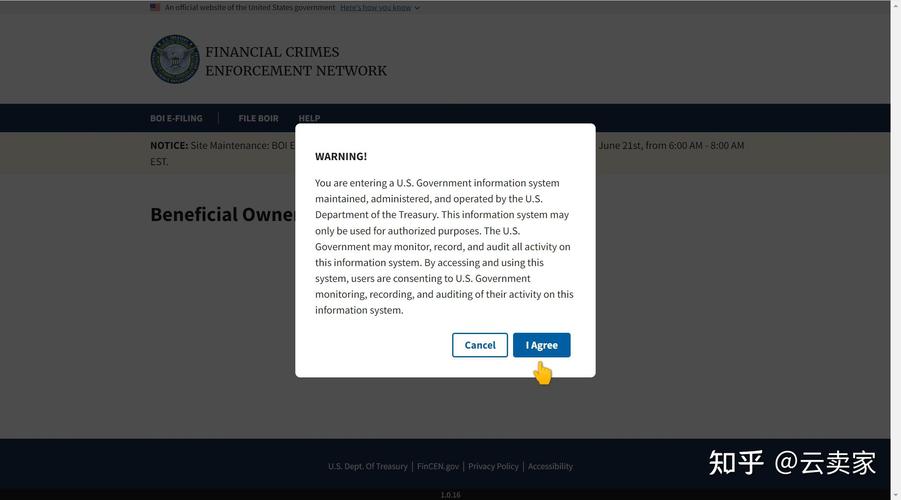

Fincen Boy Reporting, also known as the Bank Secrecy Act (BSA) E-filing, is a regulatory requirement for financial institutions in the United States. It involves the reporting of certain transactions and activities that may indicate money laundering, terrorist financing, or other financial crimes. The purpose of this reporting is to help financial institutions monitor and report suspicious activities to the Financial Crimes Enforcement Network (FinCEN).

Understanding Line 38

Line 38 of the Fincen Boy Reporting E-file is where financial institutions report cash transactions exceeding $10,000. This line is crucial because it helps FinCEN identify potential money laundering activities. Here’s a breakdown of what needs to be reported on line 38:

| Field | Description |

|---|---|

| Transaction Date | The date on which the cash transaction occurred. |

| Transaction Amount | The total amount of cash involved in the transaction. |

| Customer Information | Details about the customer involved in the transaction, such as name, address, and account number. |

| Transaction Description | A brief description of the transaction, including the nature of the business or activity. |

It’s important to note that financial institutions must report cash transactions exceeding $10,000 within 15 calendar days of the transaction date. Failure to comply with this requirement can result in penalties and fines from FinCEN.

Impact of Line 38 on Financial Reporting

Line 38 plays a significant role in financial reporting for several reasons:

-

Compliance: Proper reporting on line 38 ensures that financial institutions comply with BSA regulations and avoid potential penalties.

-

Identification of Suspicious Activities: By reporting cash transactions exceeding $10,000, financial institutions help FinCEN identify potential money laundering activities and other financial crimes.

-

Customer Due Diligence: Reporting on line 38 can help financial institutions enhance their customer due diligence processes, ensuring they have a better understanding of their customers’ financial activities.

Best Practices for Reporting on Line 38

Here are some best practices to ensure accurate and timely reporting on line 38:

-

Training: Ensure that all employees involved in the reporting process are adequately trained on BSA regulations and the specific requirements of line 38.

-

Monitoring: Regularly monitor cash transactions exceeding $10,000 to ensure timely reporting.

-

Documentation: Keep detailed records of all transactions exceeding $10,000, including supporting documentation.

-

Review: Regularly review the reporting process to identify any potential issues or areas for improvement.

Conclusion

Line 38 of the Fincen Boy Reporting E-file is a critical component of financial reporting, especially for transactions exceeding $10,000. By understanding the requirements and best practices for reporting on this line, financial institutions can ensure compliance with BSA regulations and contribute to the fight against financial crimes.