Understanding IRS.gov Free File: A Comprehensive Guide for You

Are you looking to file your taxes online but worried about the costs? Well, you’re in luck! The IRS offers a free tax filing service known as Free File. This guide will delve into the details of IRS.gov Free File, helping you understand how it works, who is eligible, and how to make the most of this valuable resource.

What is IRS.gov Free File?

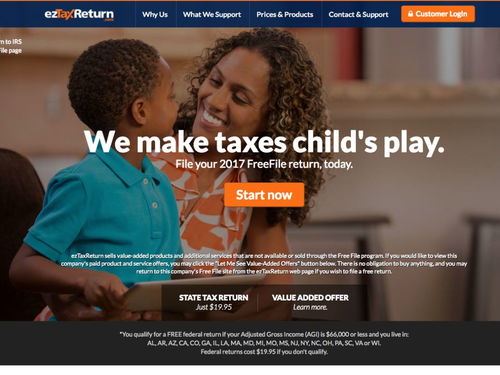

IRS.gov Free File is a program that allows eligible taxpayers to file their federal income tax returns for free. This service is provided by participating tax software companies, which have partnered with the IRS to offer this benefit to the public.

Who is Eligible for Free File?

Not everyone is eligible for Free File, but the criteria are quite broad. Here’s what you need to know:

-

Income: If your adjusted gross income (AGI) was $72,000 or less in 2022, you are eligible to use Free File. This includes individuals, married couples filing jointly, qualifying widows/widowers, and heads of household.

-

Age: If you are 65 or older, you may also qualify for Free File, regardless of your income.

-

State Taxes: Some Free File providers offer state tax filing for free as well. Check with your chosen provider to see if this is available.

How to Use IRS.gov Free File

Using IRS.gov Free File is a straightforward process. Here’s a step-by-step guide:

-

Visit the IRS.gov website and click on the “Free File” link.

-

Select a participating tax software provider from the list. Some popular options include H&R Block, TurboTax, and TaxAct.

-

Choose the Free File option if it’s available for your income level.

-

Follow the prompts to enter your personal and tax information.

-

Review your tax return and submit it to the IRS.

Benefits of Using IRS.gov Free File

There are several benefits to using IRS.gov Free File:

-

Save Money: The most obvious benefit is that you can file your taxes for free, which can save you hundreds of dollars in tax preparation fees.

-

Accuracy: Free File providers use the same tax software as paid services, ensuring that your tax return is accurate.

-

Security: The IRS has strict security measures in place to protect your personal and financial information.

-

Support: Many Free File providers offer customer support to help you with any questions or issues you may encounter.

Top Free File Providers

Here’s a table of some of the top Free File providers and their key features:

| Provider | Key Features |

|---|---|

| H&R Block | Free federal and state tax filing, audit support, and financial planning tools. |

| TurboTax | Free federal and state tax filing, audit defense, and financial planning tools. |

| FreeTaxUSA | Free federal and state tax filing, audit support, and financial planning tools. |

| TaxAct | Free federal and state tax filing, audit support, and financial planning tools. |

Common Questions About IRS.gov Free File

Here are some common questions about IRS.gov Free File, along with their answers:

-

Q: Can I file my taxes for free if I have a business or self-employment income?

A: Some Free File providers offer free filing for businesses and self-employment income, but it depends on the provider and your specific situation. Check with your chosen provider for details.

-

Q: Can I file my taxes for