Understanding Sales Tax Revenue in Florida: A Detailed Insight

When it comes to understanding the financial landscape of a state, one of the key indicators is the revenue generated from sales taxes. In the case of Florida, sales tax revenue plays a significant role in funding state programs and services. This article delves into the various aspects of sales tax revenue in Florida, providing you with a comprehensive overview.

How Sales Tax Revenue is Collected in Florida

In Florida, the state collects sales tax revenue through a system where retailers are required to charge a 6% sales tax on most goods and services. This tax is then remitted to the state government. Additionally, local governments may impose their own sales tax, which can vary from one county to another.

Here’s a breakdown of the sales tax rates in Florida:

| Local Government | Sales Tax Rate |

|---|---|

| Statewide | 6% |

| Local Governments | Up to 7.5% (varies by county) |

Top Industries Contributing to Sales Tax Revenue

Several industries contribute significantly to Florida’s sales tax revenue. Here are some of the key sectors:

-

Real Estate: Florida’s thriving real estate market, driven by factors like favorable weather and tourism, contributes a substantial amount to sales tax revenue.

-

Tourism: As a popular tourist destination, Florida’s hospitality industry generates a significant portion of sales tax revenue through hotels, restaurants, and attractions.

-

Construction: The construction industry, including residential and commercial projects, also contributes to sales tax revenue through the purchase of materials and services.

-

Automotive: Florida’s automotive industry, including new and used car sales, contributes to sales tax revenue through the purchase of vehicles and related services.

Impact of Sales Tax Revenue on State Programs

Sales tax revenue in Florida is used to fund a wide range of state programs and services. Here are some of the key areas where this revenue is allocated:

-

Educational Programs: A significant portion of sales tax revenue is allocated to public education, including funding for schools, teachers, and educational resources.

-

Healthcare: Sales tax revenue also supports healthcare programs, including funding for hospitals, clinics, and medical research.

-

Infrastructure: The state uses sales tax revenue to fund infrastructure projects, such as road repairs, bridges, and public transportation.

-

Public Safety: Sales tax revenue contributes to public safety initiatives, including funding for law enforcement, fire departments, and emergency services.

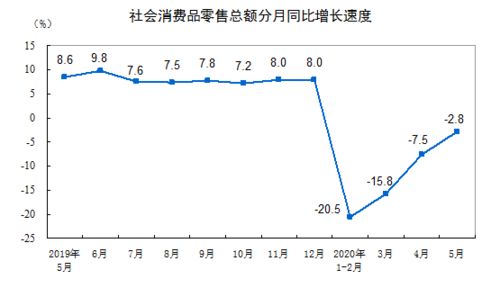

Changes in Sales Tax Revenue Over Time

Over the years, Florida’s sales tax revenue has seen fluctuations due to various economic factors. Here’s a brief overview of the trends:

-

2008 Recession: During the 2008 recession, Florida’s sales tax revenue experienced a decline due to reduced consumer spending and economic uncertainty.

-

Recovery Period: Following the recession, the state’s sales tax revenue gradually recovered as the economy improved and consumer spending increased.

-

Recent Trends: In recent years, Florida’s sales tax revenue has continued to grow, reflecting the state’s strong economic performance and increasing consumer confidence.

Conclusion

Understanding the dynamics of sales tax revenue in Florida is crucial for assessing the state’s financial health and the impact of economic factors on its programs and services. By examining the various aspects of sales tax revenue, we can gain insights into how this revenue is collected, allocated, and utilized to support the state’s needs.