File California State Taxes for Free: A Comprehensive Guide

Are you looking to file your California state taxes without spending a dime? You’re in luck! There are several free options available to you, each with its own set of benefits and requirements. Whether you’re a beginner or a seasoned tax filer, this guide will help you navigate the process and find the best free option for you.

Understanding Your Options

Before diving into the specifics of each free tax filing option, it’s important to understand the different types of services available. Here are the main categories:

- Free File Software: Online tax preparation software that offers free filing for eligible taxpayers.

- Free File Fillable Forms: A free version of the IRS’s fillable tax forms that you can download and print.

- Community Tax Assistance: Free tax preparation services offered by volunteers and organizations.

Free File Software

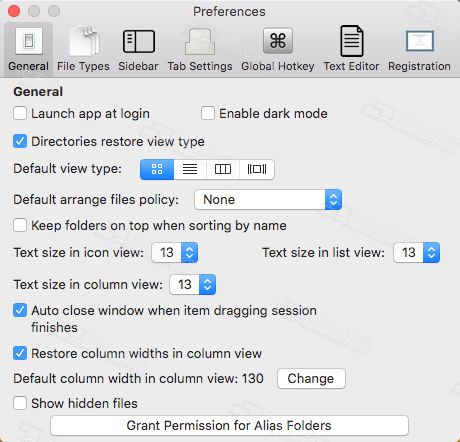

Free File software is a popular choice for many taxpayers, as it offers a user-friendly interface and step-by-step guidance through the tax filing process. Here are some of the top free file software options available:

| Software | Eligibility Requirements | Maximum Income Limit |

|---|---|---|

| Free File Fillable Forms | No income or age requirements | Varies by state |

| H&R Block Free | Income under $66,000 | Varies by state |

| TurboTax Free Edition | Income under $100,000 | Varies by state |

| FreeTaxUSA | Income under $66,000 | Varies by state |

When choosing a free file software, make sure to compare the features, support, and user reviews to find the best option for your needs.

Free File Fillable Forms

Free File Fillable Forms is a free service offered by the IRS that allows you to download and print out the IRS’s fillable tax forms. This option is best for taxpayers who are comfortable with paper forms and want to file their taxes manually.

Here are some tips for using Free File Fillable Forms:

- Download the forms from the IRS website.

- Complete the forms online or print them out and fill them in by hand.

- Follow the instructions provided by the IRS to ensure accurate filing.

Community Tax Assistance

Community tax assistance programs offer free tax preparation services to eligible taxpayers. These programs are often available at local libraries, community centers, and churches. Here are some of the benefits of using community tax assistance:

- Free tax preparation services

- Expert assistance from trained volunteers

- Access to free tax filing software

Here are some of the top community tax assistance programs available:

| Program | Eligibility Requirements | Services Offered |

|---|---|---|

| AARP Tax-Aide | Income under $50,000 | Free tax preparation and counseling |

| Volunteer Income Tax Assistance (VITA) | Income under $57,000 | Free tax preparation and counseling |

| Tax Counseling for the Elderly (TCE) | Age 60 or older | Free tax preparation and counseling |

When using community tax assistance, be sure to bring all necessary documents, such as your Social Security card, W-2 forms, and bank account information.