File a Progressive Claim: A Comprehensive Guide

When it comes to making a progressive claim, understanding the process and the nuances involved is crucial. Whether you are an individual seeking financial assistance or a business owner looking to expand, filing a progressive claim can be a complex task. In this article, we will delve into the details of what a progressive claim is, how to file one, and the benefits it can bring.

What is a Progressive Claim?

A progressive claim is a type of insurance claim that allows policyholders to receive payments over time, rather than receiving the entire amount at once. This is particularly beneficial for claims that involve a significant amount of money, such as property damage or medical expenses.

Progressive claims are commonly used in the following scenarios:

-

Property damage claims, where repairs or reconstruction may take an extended period.

-

Medical claims, where ongoing treatment or rehabilitation is required.

-

Business interruption claims, where a company needs to recover from a loss and continue operations.

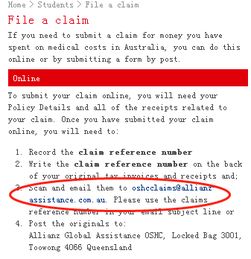

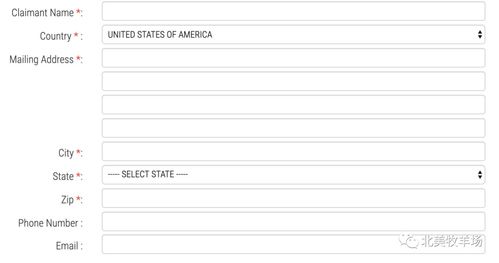

How to File a Progressive Claim

Filing a progressive claim involves several steps, and it is important to follow them carefully to ensure a smooth process. Here is a detailed guide on how to file a progressive claim:

-

Contact your insurance provider as soon as possible after the incident. Provide them with all the necessary details, including the date of the incident, the extent of the damage, and any other relevant information.

-

Submit a formal claim. This can typically be done online, through the insurance company’s website, or by filling out a paper form. Be sure to include all the required documentation, such as photographs of the damage, repair estimates, and medical records.

-

Wait for the insurance company to review your claim. This process may take several weeks, depending on the complexity of the claim and the volume of claims the insurance company is handling.

-

Once your claim is approved, you will receive an initial payment. This payment will be a portion of the total claim amount, and it will be used to cover immediate expenses or repairs.

-

Continue to provide updates to the insurance company as the repairs or treatment progress. This will help ensure that you receive the appropriate payments at the right time.

-

Once the repairs or treatment are complete, submit a final claim to receive the remaining funds.

Benefits of Filing a Progressive Claim

Filing a progressive claim offers several benefits, including:

-

Financial Relief: Progressive claims provide policyholders with immediate financial relief, allowing them to cover expenses as they arise.

-

Peace of Mind: Knowing that you will receive payments over time can help alleviate stress and anxiety during a difficult time.

-

Flexibility: Progressive claims offer flexibility in managing funds, as policyholders can use the payments as needed.

-

Reduced Financial Burden: By spreading out payments over time, policyholders can avoid the burden of paying a large sum of money all at once.

Understanding Progressive Claim Limits

It is important to note that progressive claims have limits. These limits are typically determined by the insurance policy and can vary depending on the type of claim. Here are some key points to consider regarding progressive claim limits:

-

Policy Limits: Progressive claims are subject to the policy limits set by the insurance company. These limits can vary based on the type of coverage and the amount of insurance purchased.

-

Payment Schedule: The payment schedule for a progressive claim is determined by the insurance company and may be based on the estimated cost of repairs or treatment.

-

Adjustments: If the actual cost of repairs or treatment exceeds the initial estimate, the insurance company may adjust the payment schedule accordingly.

Common Challenges in Filing a Progressive Claim

While filing a progressive claim can be beneficial, it is not without its challenges. Some common challenges include:

-

Documentation: Gathering all the necessary documentation can be time-consuming and may require multiple