Understanding the Power of File Extension .tax: A Comprehensive Guide

When it comes to managing financial data, the file extension .tax plays a crucial role. This article delves into the various aspects of this file format, providing you with a detailed understanding of its significance, usage, and benefits.

What is a .tax File?

A .tax file is a type of file format used for storing tax-related information. It is commonly used by tax preparation software, accounting applications, and financial institutions. These files contain data such as income, deductions, credits, and other financial information necessary for tax calculations and reporting.

Why Use .tax Files?

There are several reasons why .tax files are preferred over other file formats for tax-related purposes:

-

Security: .tax files are encrypted, ensuring that sensitive financial information remains secure.

-

Compatibility: .tax files are compatible with various tax preparation software and accounting applications, making it easy to share and transfer data.

-

Accuracy: .tax files are designed to minimize errors in tax calculations, ensuring accurate financial reporting.

How to Create a .tax File

Creating a .tax file is a straightforward process. Here’s a step-by-step guide:

-

Choose a tax preparation software or accounting application that supports .tax files.

-

Enter your financial information, such as income, deductions, and credits.

-

Save the file with a .tax extension.

How to Open a .tax File

Opening a .tax file is equally simple. Follow these steps:

-

Locate the .tax file on your computer.

-

Double-click the file to open it with the appropriate software.

Common Uses of .tax Files

Here are some of the most common uses of .tax files:

-

Personal Tax Preparation: Individuals use .tax files to prepare and file their tax returns.

-

Business Tax Preparation: Businesses use .tax files to manage their financial records and file tax returns.

-

Accounting and Auditing: Accountants and auditors use .tax files to review financial records and ensure compliance with tax regulations.

Benefits of Using .tax Files

Using .tax files offers several benefits, including:

-

Time-saving: .tax files streamline the tax preparation process, saving you time and effort.

-

Accuracy: .tax files minimize errors in tax calculations, ensuring accurate financial reporting.

-

Security: .tax files are encrypted, protecting your financial information from unauthorized access.

Best Practices for Managing .tax Files

Here are some best practices for managing .tax files:

-

Backup: Regularly backup your .tax files to prevent data loss.

-

Encryption: Use encryption to protect your .tax files from unauthorized access.

-

Organize: Keep your .tax files organized to make it easier to find and manage them.

Common Issues with .tax Files

While .tax files are generally reliable, there are some common issues you may encounter:

-

Corruption: .tax files can become corrupted, leading to data loss or errors.

-

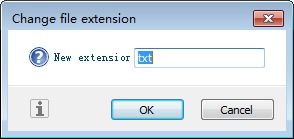

Incompatibility: Some .tax files may not be compatible with certain software or devices.

-

Security Breaches: .tax files can be vulnerable to security breaches if not properly protected.

Alternatives to .tax Files

While .tax files are widely used, there are alternative file formats for tax-related purposes:

-

CSV (Comma-Separated Values): CSV files are a simple and widely compatible format for storing financial data.

-

Excel (XLSX): Excel files are commonly used for managing financial data