File Taxes Electronically for Free: A Comprehensive Guide

Are you looking to file your taxes without spending a dime? Filing taxes electronically for free is not only convenient but also offers numerous benefits. In this article, we will explore the various options available to you, ensuring that you can file your taxes efficiently and effectively without any cost.

Understanding the Basics

Before diving into the details, it’s essential to understand the basics of electronic tax filing. E-filing allows you to submit your tax return to the IRS or your state tax agency online. This method is faster, more accurate, and often more secure than traditional paper filing.

Free E-Filing Options

Several free e-filing options are available, catering to different needs and income levels. Let’s explore some of the most popular ones:

| Option | Description | Best For |

|---|---|---|

| IRS Free File | Offered by the IRS, this service provides free tax preparation and filing for eligible taxpayers. | Individuals with an adjusted gross income (AGI) of $72,000 or less |

| H&R Block Free File | H&R Block offers free tax preparation and filing for eligible taxpayers through its Free File program. | Individuals with an AGI of $66,000 or less |

| TurboTax Free Edition | TurboTax provides a free version of its software for eligible taxpayers. | Individuals with an AGI of $34,000 or less |

| Free File Fillable Forms | This option allows you to fill out and e-file your tax return using the IRS’s fillable forms. | Individuals with an AGI of $66,000 or less |

Choosing the Right Free E-Filing Service

When selecting a free e-filing service, consider the following factors:

-

Income Eligibility: Ensure that the service you choose meets your income requirements.

-

State Tax Filing: Some free e-filing services offer free state tax filing, while others charge a fee.

-

Support and Resources: Look for services that provide helpful resources, such as FAQs, tutorials, and customer support.

-

Security: Ensure that the service offers secure data encryption and other security measures to protect your personal information.

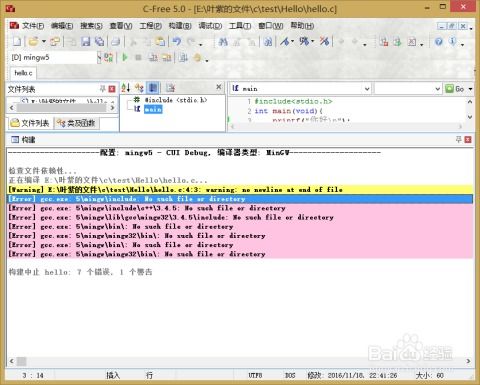

How to File Taxes Electronically for Free

Follow these steps to file your taxes electronically for free:

-

Choose a free e-filing service: Select a service that meets your needs and income requirements.

-

Collect necessary documents: Gather your tax documents, such as W-2s, 1099s, and other relevant information.

-

Enter your information: Enter your personal and financial information into the e-filing service.

-

Review and submit: Review your tax return for accuracy and submit it to the IRS or your state tax agency.

-

Track your refund: Use the IRS’s “Where’s My Refund” tool to track the status of your refund.

Benefits of Free E-Filing

There are several benefits to filing your taxes electronically for free:

-

Time-Saving: E-filing is faster than paper filing, allowing you to spend less time on your taxes.

-

Accuracy: E-filing reduces the likelihood of errors, ensuring that your tax return is accurate.

-

Security: E-filing is more secure than paper filing, protecting your personal information from theft.

-

Refund Speed: E-filing often results in faster refunds compared to paper filing.

Conclusion

Filing taxes electronically for free is a convenient, accurate,