How Long Does a Repossession Stay on Your Credit File?

Understanding the impact of a repossession on your credit file is crucial for anyone who has experienced this situation or is at risk of it. A repossession can significantly damage your credit score and affect your ability to secure loans, credit cards, and even rental agreements. In this article, we will delve into the details of how long a repossession stays on your credit file, its implications, and what you can do to mitigate its effects.

What is Repossession?

Repossession occurs when a lender takes possession of an asset, such as a car or a home, due to the borrower’s failure to meet the terms of a loan agreement. This action is typically taken after the lender has exhausted all other options, such as sending reminders and offering repayment plans.

How Long Does a Repossession Stay on Your Credit File?

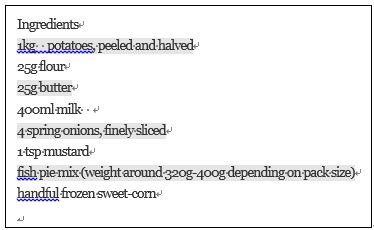

The duration for which a repossession remains on your credit file varies depending on the credit reporting agencies and the country you reside in. Here’s a breakdown of the general timelines:

| Country | Duration of Repossession on Credit File |

|---|---|

| United States | 7 years from the date of the repossession |

| United Kingdom | 6 years from the date of the repossession |

| Canada | 6 years from the date of the repossession |

| Australia | 5 years from the date of the repossession |

It’s important to note that while the repossession itself will remain on your credit file for the specified duration, the negative impact on your credit score may persist even longer. This is because the repossession will likely be accompanied by late payments and defaults, which can remain on your credit file for up to 7 years.

Implications of a Repossession on Your Credit Score

A repossession can have a severe impact on your credit score, often resulting in a drop of 100 to 200 points. This can make it difficult to secure new credit, as lenders may view you as a higher risk borrower. Here are some of the key implications:

-

Increased interest rates on loans and credit cards

-

Difficulty in obtaining new credit

-

Higher insurance premiums

-

Limitations on housing options

What You Can Do to Mitigate the Effects of a Repossession

While a repossession can be a challenging experience, there are steps you can take to minimize its impact on your credit score and financial future:

-

Pay any remaining debt on the repossessed asset

-

Dispute any errors on your credit report

-

Pay all your bills on time and in full

-

Consider a secured credit card to rebuild your credit

-

Seek financial counseling to develop a budget and improve your financial management skills

By taking these steps, you can gradually rebuild your credit and improve your financial situation over time.

Conclusion

Understanding how long a repossession stays on your credit file is essential for managing its impact on your financial future. While the repossession itself will remain on your credit file for a specified duration, its negative effects on your credit score may persist longer. By taking proactive steps to rebuild your credit and improve your financial management skills, you can overcome the challenges posed by a repossession and move towards a healthier financial future.