When to File for Bankruptcy: A Comprehensive Guide

Deciding when to file for bankruptcy is a significant financial decision that can have long-lasting implications. It’s important to understand the various factors that can influence this decision and the different types of bankruptcy available. This guide will help you navigate the complexities of bankruptcy and determine the right time to file.

Understanding Bankruptcy

Bankruptcy is a legal process that provides individuals and businesses with a fresh start by eliminating or restructuring their debts. There are two primary types of bankruptcy for individuals: Chapter 7 and Chapter 13.

| Chapter 7 Bankruptcy | Chapter 13 Bankruptcy |

|---|---|

| Entire debt is discharged. | Debt is restructured and paid off over time. |

| Assets may be liquidated to pay creditors. | Assets are not liquidated. |

| Can be filed by individuals and businesses. | Can only be filed by individuals with regular income. |

Chapter 7 bankruptcy is often referred to as a liquidation bankruptcy because it involves selling off assets to pay creditors. Chapter 13 bankruptcy, on the other hand, is a reorganization bankruptcy that allows individuals to keep their assets while paying off their debts over a period of three to five years.

Signs It’s Time to File for Bankruptcy

There are several signs that indicate it may be time to consider filing for bankruptcy:

-

Unable to pay monthly bills on time.

-

Receiving collection calls and letters from creditors.

-

Using credit cards to pay for necessities.

-

Missing payments on secured debts, such as a mortgage or car loan.

-

Debt consolidation loans have not improved your financial situation.

-

Income has significantly decreased, making it difficult to meet financial obligations.

It’s important to note that these signs are not definitive proof that bankruptcy is the right choice. However, they can serve as indicators that you may need to seek professional advice.

Considerations Before Filing for Bankruptcy

Before deciding to file for bankruptcy, consider the following factors:

-

Financial Situation: Assess your current financial situation, including your income, expenses, and debts. Determine if bankruptcy is the only viable option to resolve your financial problems.

-

Asset Protection: Understand the bankruptcy exemptions in your state to determine which assets you can keep. This includes your home, car, and personal belongings.

-

Impact on Credit: Filing for bankruptcy will negatively impact your credit score. However, it’s important to consider the long-term benefits of bankruptcy, such as debt relief and the opportunity to rebuild your credit.

-

Legal Costs: Bankruptcy can be expensive. Consider the costs of hiring a bankruptcy attorney and the potential fees associated with the bankruptcy process.

-

Alternatives: Explore other options, such as debt consolidation, credit counseling, or negotiating with creditors to resolve your debt.

How to File for Bankruptcy

Filing for bankruptcy involves several steps:

-

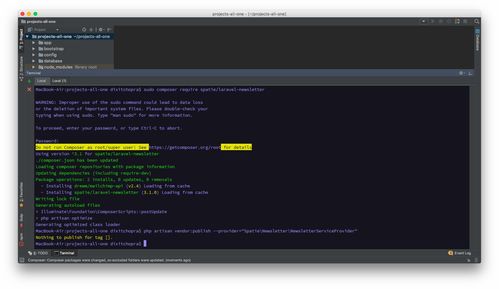

Consult with a Bankruptcy Attorney: An attorney can provide guidance on the best type of bankruptcy for your situation and help you navigate the legal process.

-

Complete Credit Counseling: You must complete a credit counseling course from an approved provider within six months before filing for bankruptcy.

-

Prepare and File Bankruptcy Petition: Gather all necessary documents and file your bankruptcy petition with the court.

-

Attend Credit Counseling Course: Complete a second credit counseling course after filing for bankruptcy.

-

Attend Meeting of Creditors: Attend a meeting with your creditors and the bankruptcy trustee to discuss