File Tax Extension with TurboTax: A Comprehensive Guide

Are you facing a situation where you need to file a tax extension? Don’t worry; you’re not alone. Many taxpayers find themselves in a similar situation every year. One of the most popular and reliable tools for filing tax extensions is TurboTax. In this article, we will delve into the details of how to file a tax extension using TurboTax, covering various aspects such as eligibility, the process, and tips for a smooth experience.

Eligibility for Tax Extensions

Before diving into the process, it’s essential to understand who is eligible for a tax extension. Generally, individuals and businesses can apply for a tax extension if they are unable to file their tax returns by the deadline. However, there are certain conditions that must be met. Here’s a quick overview:

| Eligibility Criteria | Description |

|---|---|

| Individual Taxpayers | Must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN). |

| Business Taxpayers | Must have an Employer Identification Number (EIN) or Social Security number. |

| Nonresident Aliens | Must have a valid Tax Identification Number (TIN) or ITIN. |

It’s important to note that while an extension to file is automatic, you must still pay any taxes owed by the original filing deadline to avoid penalties and interest.

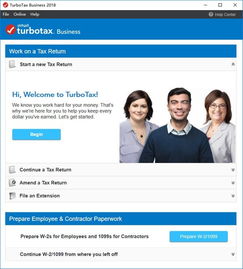

How to File a Tax Extension with TurboTax

Now that you know who is eligible for a tax extension, let’s explore how to file one using TurboTax. The process is straightforward and can be completed in a few simple steps:

-

Access TurboTax Online or TurboTax Desktop.

-

Sign in to your account or create a new one if you’re a first-time user.

-

Start a new tax return or continue with an existing one.

-

Follow the prompts to select the tax year for which you need an extension.

-

Choose the “File an Extension” option.

-

Enter your personal information, including your Social Security number or EIN.

-

Review the information and submit your extension request.

-

Pay any taxes owed by the original filing deadline to avoid penalties and interest.

Once you’ve submitted your extension request, you’ll receive a confirmation email or notification. It’s important to keep this confirmation for your records.

Understanding the Extension Deadline

When you file a tax extension, you’re essentially asking the IRS for an additional six months to file your tax return. However, it’s crucial to understand that the extension deadline is not an extension to pay your taxes. You must still pay any taxes owed by the original filing deadline to avoid penalties and interest.

Here’s a breakdown of the key dates:

-

Original Filing Deadline: April 15th for most taxpayers.

-

Extension Deadline: October 15th for most taxpayers.

-

Payment Deadline: April 15th for taxes owed.

It’s important to note that if you’re unable to pay your taxes by the original filing deadline, you may still be subject to penalties and interest. In such cases, consider applying for an installment agreement with the IRS to avoid these penalties.

Tips for a Smooth Tax Extension Experience

Now that you know how to file a tax extension using TurboTax, here are some tips to ensure a smooth experience:

-

Stay organized: Keep all your tax documents and records in one place to make the process easier.

-

Double-check your information: Ensure that all the information you provide is accurate and up-to-date.

-

Pay any taxes owed: Don’t forget to pay any taxes owed by the original filing deadline to avoid penalties and interest.

-