Understanding “File Taxes Free”: A Comprehensive Guide

Are you looking to file your taxes without any hassle? Do you want to ensure that you’re not paying more than you need to? If so, you’ve come to the right place. “File Taxes Free” is a concept that has gained popularity in recent years, and for good reason. It’s about making the tax filing process as simple and cost-effective as possible. Let’s delve into what it means, how it works, and the benefits it offers.

What is “File Taxes Free”?

“File Taxes Free” refers to the process of filing your taxes without paying for professional tax preparation services. This can be done either by yourself or by using free online tax preparation software. The main idea is to save money on tax preparation fees while still ensuring that your taxes are filed accurately and on time.

How Does “File Taxes Free” Work?

There are several ways to file taxes for free:

-

Using Free Online Tax Preparation Software

-

Using IRS Free File

-

Using Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) Programs

Let’s take a closer look at each of these options.

Using Free Online Tax Preparation Software

There are several reputable online tax preparation software companies that offer free versions of their services for eligible taxpayers. These free versions are typically available for those with an adjusted gross income (AGI) of $66,000 or less. Some of the popular free online tax preparation software options include:

| Software | Maximum AGI | Features |

|---|---|---|

| H&R Block Free | $66,000 | Free federal and state tax preparation, e-filing, and audit support |

| TurboTax Free Edition | $66,000 | Free federal and state tax preparation, e-filing, and audit support |

| FreeTaxUSA | $66,000 | Free federal and state tax preparation, e-filing, and audit support |

These free versions typically offer the same features as the paid versions, such as step-by-step guidance, tax credits and deductions, and the ability to e-file your taxes. However, some features may be limited or not available in the free versions.

Using IRS Free File

The IRS offers a free tax filing service called Free File, which is available to eligible taxpayers. To qualify for Free File, you must have an AGI of $72,000 or less. The IRS partners with several tax software companies to offer this service. Some of the participating companies include:

-

H&R Block

-

TurboTax

-

FreeTaxUSA

When using Free File, you can choose from a variety of tax preparation software options, and the IRS guarantees that your tax return will be free of charge. This is a great option for those who prefer to use a well-known tax preparation company.

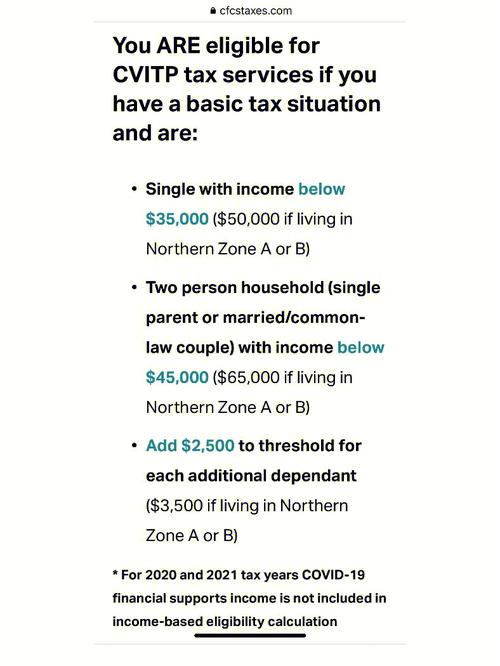

Using Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) Programs

For those who need additional help with their taxes, the IRS offers free tax preparation assistance through the VITA and TCE programs. These programs are staffed by trained volunteers who can help you prepare and file your taxes for free. VITA is available to individuals with an AGI of $57,000 or less, while TCE is available to taxpayers aged 60 and older.

These programs are particularly beneficial for those who may not be comfortable preparing their own taxes or who have complex tax situations. The volunteers can help you navigate the tax code, identify potential tax credits and deductions, and ensure that your taxes are filed accurately.

Benefits of “File Taxes Free”

There are several benefits to filing taxes for free:

-

Save Money

-

Access to Free Resources