Best Tax Filer: A Comprehensive Guide to Maximizing Your Tax Return

Are you looking to maximize your tax return? Do you want to ensure that you’re taking advantage of every possible deduction and credit? If so, you’ve come to the right place. In this article, we’ll delve into the world of tax filing and provide you with a detailed guide to becoming the best tax filer possible.

Understanding the Basics

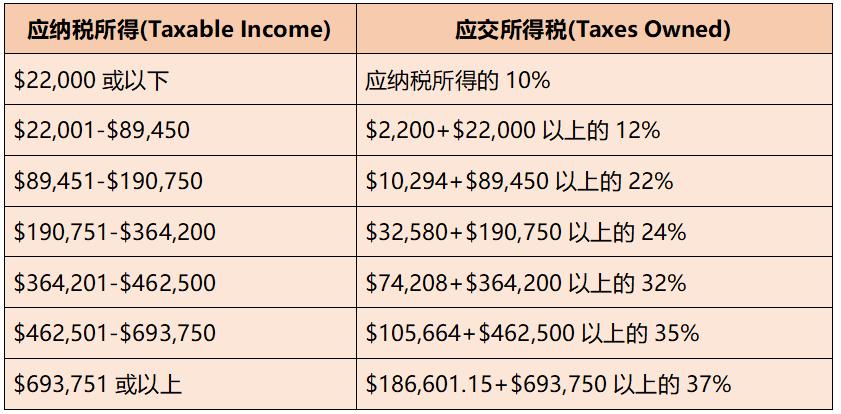

Before diving into the specifics of tax filing, it’s important to have a solid understanding of the basics. Taxes are a legal requirement for individuals and businesses to pay a portion of their income to the government. The amount of tax you owe depends on various factors, including your income, filing status, and any deductions or credits you may be eligible for.

Choosing the Right Filing Status

Your filing status is one of the most important factors in determining your tax liability. There are five filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Each status has its own set of rules and eligibility requirements. It’s crucial to choose the status that best fits your situation to ensure you’re not overpaying in taxes.

| Filing Status | Description | Eligibility |

|---|---|---|

| Single | For individuals who are not married, legally separated, or widowed. | Not married, legally separated, or widowed. |

| Married Filing Jointly | For married couples who choose to file a joint tax return. | Married at the end of the tax year. |

| Married Filing Separately | For married couples who choose to file separate tax returns. | Married at the end of the tax year. |

| Head of Household | For individuals who are unmarried, have a dependent child, and paid more than half of the cost of keeping up a home for the child. | Unmarried, have a dependent child, and paid more than half of the cost of keeping up a home for the child. |

| Qualifying Widow(er) with Dependent Child | For widows or widowers who have a dependent child and have not remarried. | Widow or widower with a dependent child and not remarried. |

Identifying Deductions and Credits

One of the key aspects of becoming the best tax filer is identifying all the deductions and credits you’re eligible for. Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. Some common deductions and credits include the standard deduction, mortgage interest deduction, state and local taxes deduction, child tax credit, and earned income credit.

Using Tax Software or Hiring a Professional

While you can file your taxes manually using IRS forms, many people choose to use tax software or hire a professional tax preparer. Tax software, such as TurboTax or H&R Block, can help you navigate the complexities of tax filing and ensure you’re taking advantage of all available deductions and credits. If you’re unsure about your tax situation or have a complex return, hiring a professional tax preparer may be the best option.

Keeping Accurate Records

Accurate record-keeping is essential for a successful tax filing. Keep receipts, invoices, and other documentation for all your financial transactions throughout the year. This will help you substantiate any deductions or credits you claim and make the tax filing process smoother.

Understanding Tax Penalties and Interest

It’s important to understand the potential penalties and interest you may incur if you file your taxes late or fail to pay the correct amount of tax. The IRS imposes penalties for late filing and late payment, as well as interest on any unpaid tax. To avoid these penalties and interest, be sure to file your taxes on time and pay any tax owed by the deadline.