Understanding Disaster Loans and UCC Filings: A Comprehensive Guide for Borrowers

When disaster strikes, businesses often find themselves in dire need of financial assistance. One such form of aid is the disaster loan, which can provide the necessary funds to recover and rebuild. One crucial aspect of securing a disaster loan is the UCC filing, which stands for Uniform Commercial Code filing. In this article, we will delve into the details of disaster loans and UCC filings, explaining their importance and how they work together to help businesses bounce back from adversity.

What is a Disaster Loan?

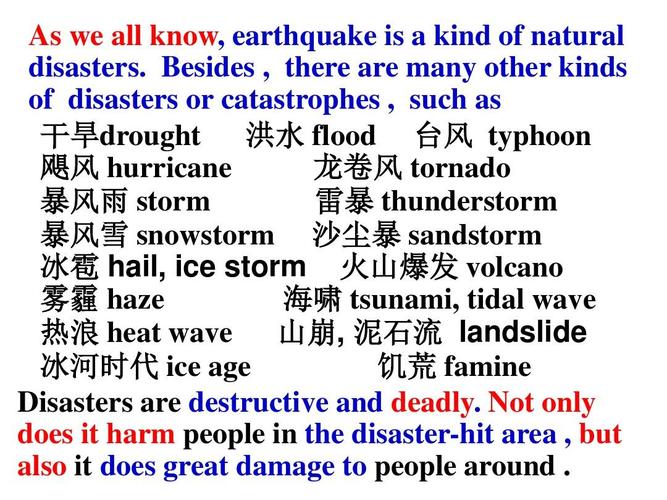

A disaster loan is a type of financial assistance provided by the government or private lenders to businesses affected by natural disasters, such as hurricanes, floods, or wildfires. These loans are designed to help businesses cover their immediate financial needs, such as lost income, property damage, and other expenses related to the disaster.

Disaster loans can be obtained from various sources, including the Small Business Administration (SBA), state and local governments, and private lenders. The SBA offers the most common type of disaster loan, known as the SBA Disaster Loan, which provides low-interest, long-term financing to eligible businesses.

Understanding UCC Filings

The Uniform Commercial Code (UCC) is a set of laws that govern commercial transactions in the United States. One of the key aspects of the UCC is the UCC filing, which is a public record that provides notice to creditors and other interested parties about a business’s financial obligations and assets.

When a business applies for a disaster loan, it may be required to file a UCC financing statement. This statement is a legal document that outlines the terms of the loan, such as the amount borrowed, interest rate, and repayment schedule. By filing a UCC financing statement, the business ensures that its creditors are aware of the loan and that the loan is secured by the business’s assets.

The Importance of UCC Filings in Disaster Loans

UCC filings play a crucial role in the disaster loan process for several reasons:

-

Asset Security: By filing a UCC financing statement, the business ensures that its assets are protected in the event of default on the loan. This means that if the business fails to repay the loan, the lender can take legal action to recover the funds, including seizing and selling the business’s assets.

-

Transparency: UCC filings provide transparency to creditors and other interested parties, allowing them to assess the business’s financial health and make informed decisions about lending or investing in the business.

-

Priority of Claims: UCC filings establish the priority of claims in the event of bankruptcy or liquidation. This ensures that the lender’s claim is given priority over other creditors, increasing the likelihood of recovering the loan amount.

How to File a UCC Financing Statement for a Disaster Loan

Filing a UCC financing statement for a disaster loan involves the following steps:

-

Identify the Borrower: The borrower must provide its name, address, and other identifying information.

-

Identify the Lender: The lender must provide its name, address, and other identifying information.

-

Describe the Collateral: The borrower must describe the assets that are securing the loan, such as equipment, inventory, or real estate.

-

File the Financing Statement: The borrower must file the financing statement with the appropriate state filing office. The filing fee varies by state.

-

Keep the Financing Statement Current: The borrower must keep the financing statement active by filing a continuation statement before the expiration date.

Table: UCC Filing Fees by State

Related Stories

| State | Filing Fee |

|---|---|

| California | $25 |

| Florida | $30 |

| New York | $25 |

| Texas | $25 |