Understanding the Allstate File a Claim Process: A Comprehensive Guide for You

When you find yourself in a situation where you need to file a claim with Allstate, it can be an overwhelming experience. However, with the right information and guidance, you can navigate through the process smoothly. In this article, we will delve into the various aspects of filing a claim with Allstate, ensuring that you are well-prepared and informed.

What is a Claim?

A claim is a formal request made by an insured individual or entity to their insurance company for compensation or reimbursement for a loss covered under their insurance policy. This could be due to an accident, theft, or any other covered event. When you file a claim with Allstate, you are essentially seeking financial assistance to cover the costs associated with the loss.

Types of Claims You Can File with Allstate

Understanding the different types of claims you can file with Allstate is crucial. Here are some common types of claims:

| Type of Claim | Description |

|---|---|

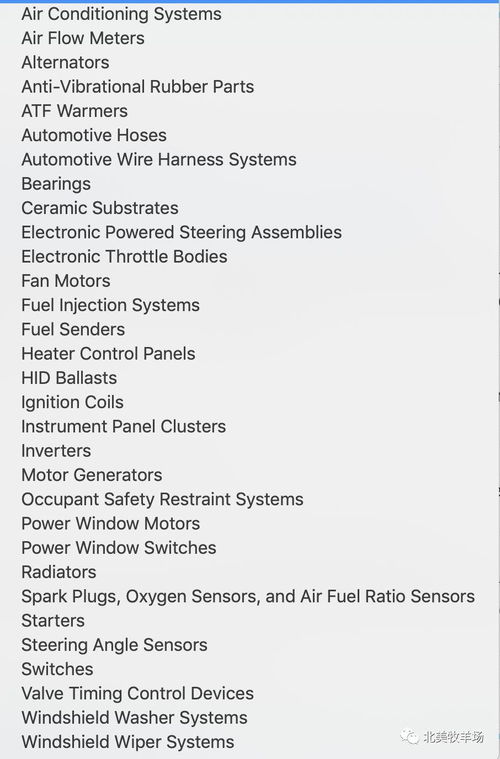

| Auto Insurance Claim | Claim related to damage or loss of your vehicle due to an accident, theft, or other covered events. |

| Homeowners Insurance Claim | Claim related to damage or loss of your home, personal property, or liability issues. |

| Life Insurance Claim | Claim related to the death of the insured person, providing financial benefits to the beneficiaries. |

| Health Insurance Claim | Claim related to medical expenses incurred by the insured individual, covered under their health insurance policy. |

How to File a Claim with Allstate

Filing a claim with Allstate is a straightforward process. Here are the steps you need to follow:

-

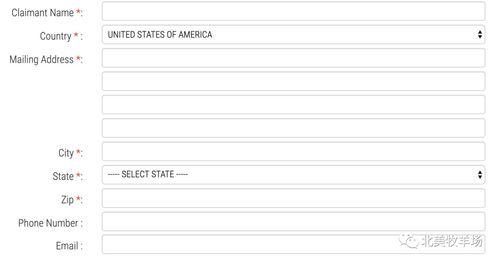

Contact Allstate: The first step is to contact Allstate and report your claim. You can do this by calling their customer service hotline or through their online claim reporting system.

-

Provide necessary information: When reporting your claim, be prepared to provide details about the incident, such as the date, time, location, and a description of what happened.

-

Submit documentation: Allstate may require you to submit certain documentation, such as police reports, medical bills, or repair estimates. Ensure you gather all the necessary documents before submitting your claim.

-

Wait for an adjuster: Allstate will assign an adjuster to your claim. The adjuster will review the details of your claim and assess the damage or loss. They may schedule a visit to inspect the property or vehicle.

-

Receive a settlement: Once the adjuster completes their assessment, they will provide you with a settlement offer. This offer will outline the amount Allstate is willing to pay for your claim.

-

Accept or dispute the settlement: Review the settlement offer carefully. If you agree with the amount, you can accept the offer. If you believe the offer is insufficient, you can dispute it and negotiate with Allstate.

What to Expect During the Claim Process

Understanding what to expect during the claim process can help you stay calm and focused. Here are some key points to keep in mind:

-

Timeframe: The time it takes to process a claim can vary depending on the complexity of the case. Allstate aims to resolve claims as quickly as possible, but some cases may take longer.

-

Communication: Allstate will keep you informed throughout the claim process. You can expect regular updates on the status of your claim via phone, email, or mail.

-

Documentation: Keep all relevant documents related to your claim organized and readily accessible. This includes receipts, invoices, and any correspondence with Allstate.

-

Adjuster’s visit: The adjuster may request access to the property or vehicle involved in the claim. Be prepared to provide them with the necessary access.

-

Settlement: The settlement offer may not cover the full extent of your loss. It is important to review the offer carefully and negotiate