Nifty 500 Shares Excel File: A Comprehensive Guide

Are you looking to dive deeper into the Indian stock market? Do you want to analyze the performance of the top 500 companies listed on the National Stock Exchange (NSE)? If yes, then a Nifty 500 shares Excel file could be your go-to tool. In this article, we will explore the various aspects of a Nifty 500 shares Excel file, helping you understand its importance, features, and how to use it effectively.

Understanding the Nifty 500 Index

The Nifty 500 index is a benchmark index that represents the top 500 companies listed on the NSE. It is designed to capture the overall performance of the Indian stock market. The index is a free-float market capitalization-weighted index, which means that the weight of each company in the index is based on its market capitalization adjusted for free float.

Free float refers to the portion of a company’s shares that are available for trading in the open market. By considering only the free float, the index provides a more accurate representation of the market capitalization of a company.

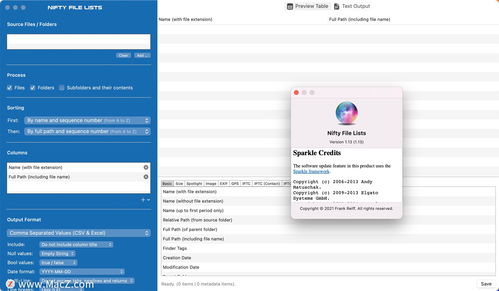

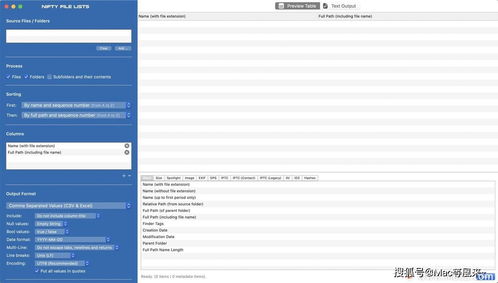

Features of a Nifty 500 Shares Excel File

A Nifty 500 shares Excel file is a comprehensive document that contains a wealth of information about the companies listed in the Nifty 500 index. Here are some of the key features of such a file:

-

Company Name: The name of the company listed in the Nifty 500 index.

-

Market Capitalization: The current market capitalization of the company, which is a measure of its size and value in the market.

-

Stock Symbol: The unique symbol assigned to the company’s stock, which is used for trading purposes.

-

Industry: The industry in which the company operates.

-

Stock Price: The current stock price of the company.

-

52-Week High/Low: The highest and lowest stock prices recorded in the last 52 weeks.

-

Dividend Yield: The dividend yield of the company, which is the percentage return on the investment in the form of dividends.

-

PE Ratio: The price-to-earnings ratio of the company, which is a measure of the valuation of the stock.

-

EPS: The earnings per share of the company, which is a measure of the company’s profitability.

Using the Nifty 500 Shares Excel File

Now that you know the features of a Nifty 500 shares Excel file, let’s explore how to use it effectively:

1. Analyzing Stock Performance

One of the primary uses of a Nifty 500 shares Excel file is to analyze the stock performance of the companies listed in the index. You can compare the stock prices, market capitalization, and other financial metrics of different companies to identify trends and patterns.

2. Portfolio Management

Investors can use the Nifty 500 shares Excel file to manage their portfolios. By analyzing the performance of different companies, investors can make informed decisions about adding or removing stocks from their portfolios.

3. Investment Opportunities

The Nifty 500 shares Excel file can help investors identify potential investment opportunities. By analyzing the financial metrics of companies, investors can identify undervalued or overvalued stocks and make informed investment decisions.

4. Market Trends

The Nifty 500 shares Excel file can also be used to analyze market trends. By studying the performance of the top 500 companies, investors can gain insights into the overall health of the Indian stock market.

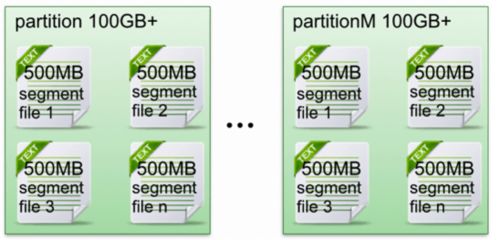

Sample Data from the Nifty 500 Shares Excel File

Here is a sample table from a Nifty 500 shares Excel file, showcasing the data for a few companies:

| Company Name | Market Capitalization | Stock Symbol | Industry | Stock Price | 52-Week High/Low | Dividend Yield | PE Ratio | EPS |

|---|---|---|---|---|---|---|---|---|

Related Stories |