File a Tax Return: A Comprehensive Guide for You

Understanding the process of filing a tax return can be daunting, especially if you’re new to it. But don’t worry, I’m here to guide you through the entire process. Whether you’re a student, a self-employed individual, or a salaried employee, this guide will help you navigate through the complexities of tax filing.

Choosing the Right Tax Filing Method

Before you start, it’s important to choose the right method for filing your tax return. The most common methods are:

| Method | Description |

|---|---|

| Online | Using tax preparation software or a tax filing service. It’s convenient, fast, and often more accurate. |

| By Mail | Printing out your tax return and sending it to the IRS. It’s less convenient but can be a good option if you prefer paper forms. |

| Through a Tax Professional | Working with a Certified Public Accountant (CPA) or a tax preparer. They can help you navigate complex situations and ensure accuracy. |

Gathering Necessary Documents

Before you start filing your tax return, gather all the necessary documents. Here’s a list of common documents you might need:

- W-2 forms from your employer

- 1099 forms for any income you received from sources other than your employer

- Proof of any deductions or credits you plan to claim

- Bank statements and other financial records

- Previous year’s tax return

Filling Out the Tax Return

Once you have all the necessary documents, it’s time to fill out your tax return. Here’s a step-by-step guide:

- Choose the Right Form: Depending on your filing status, income, and other factors, you may need to use different forms. The most common forms are Form 1040, Form 1040-SR (for seniors), and Form 1040-NR (for non-residents).

- Enter Your Personal Information: This includes your name, Social Security number, address, and filing status.

- Report Your Income: List all the income you received during the tax year, including wages, salaries, tips, and other types of income.

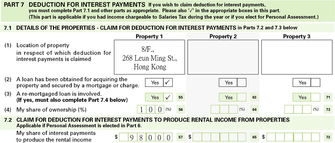

- Claim Deductions and Credits: Deductions reduce your taxable income, while credits directly reduce the amount of tax you owe. Common deductions include mortgage interest, state and local taxes, and medical expenses. Common credits include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

- Calculate Your Tax: Use the information you’ve entered to calculate the amount of tax you owe or the refund you’re entitled to.

- Sign and Date Your Return: Both you and your spouse, if applicable, must sign and date the return.

Submitting Your Tax Return

Once you’ve completed your tax return, it’s time to submit it. Here are your options:

- Online: If you’re using tax preparation software or a tax filing service, you can usually submit your return online immediately after you finish filling it out.

- By Mail: If you’re filing a paper return, you can mail it to the IRS. Be sure to follow the instructions on the form to ensure it’s processed correctly.

- Through a Tax Professional: If you’re working with a tax professional, they will submit your return for you.

What to Do If You Owe Taxes

If you owe taxes, there are several options available to you:

- Pay the Full Amount: If you can afford to pay the full amount, it’s the simplest option.

- Pay in Installments: The IRS offers an installment agreement that allows you to pay your tax debt in monthly installments.

- <