Can a Texas Franchise Tax Return BeFiled Electronically?

Understanding the process of filing a Texas Franchise Tax Return can be a daunting task, especially when it comes to electronic filing. In this comprehensive guide, we will delve into the details of whether you can file your Texas Franchise Tax Return electronically and the various aspects you need to consider.

What is a Texas Franchise Tax Return?

The Texas Franchise Tax is a state tax imposed on businesses that operate in Texas. It is based on the gross receipts of the business, minus certain deductions. The tax is applicable to most businesses, including corporations, partnerships, limited liability companies (LLCs), and other entities.

Is Electronic Filing Possible?

Yes, you can file your Texas Franchise Tax Return electronically. The Texas Comptroller of Public Accounts offers an online filing system called eFile Texas, which allows businesses to submit their tax returns securely and efficiently.

How to File Electronically

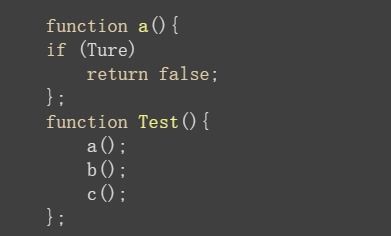

Here’s a step-by-step guide on how to file your Texas Franchise Tax Return electronically:

- Visit the Texas Comptroller of Public Accounts website.

- Navigate to the eFile Texas section.

- Register for an account if you don’t already have one.

- Log in to your account and select the appropriate tax return form.

- Enter the required information, such as your business’s gross receipts and deductions.

- Review the information for accuracy and submit the return.

- Pay any taxes due using an electronic payment method, such as credit card or electronic funds transfer.

Benefits of Electronic Filing

Electronic filing offers several advantages over traditional paper filing:

- Time Efficiency: You can file your tax return at any time, day or night, as long as you have internet access.

- Accuracy: The online system helps minimize errors by performing calculations and checking for missing information.

- Security: Your tax return is transmitted securely over the internet, protecting your sensitive information.

- Convenience: You can track the status of your tax return and receive email notifications about important updates.

Eligibility for Electronic Filing

Most businesses in Texas are eligible to file their Franchise Tax Return electronically. However, there are some exceptions:

- Businesses that are not required to file a Franchise Tax Return.

- Businesses that have been dissolved or terminated.

- Businesses that have been administratively dissolved or administratively terminated.

Penalties for Late Filing

It’s important to file your Texas Franchise Tax Return on time to avoid penalties. If you file late, you may be subject to a penalty of $50 per month, up to a maximum of $500. Additionally, you may be charged interest on any taxes due.

Support and Resources

The Texas Comptroller of Public Accounts provides various resources to help you file your Franchise Tax Return, including:

- Online Help: Accessible through the eFile Texas website, offering step-by-step instructions and troubleshooting tips.

- Customer Support: Available to assist you with any questions or issues you may encounter while filing your tax return.

- Form and Instructions: Detailed information about the tax return forms, instructions, and FAQs.

Conclusion

Filing your Texas Franchise Tax Return electronically is a convenient and secure option for most businesses. By following the steps outlined in this guide, you can ensure that your tax return is submitted accurately and on time. Take advantage of the benefits of electronic filing and save time and effort in the process.