Understanding the E-File Tax Process

When it comes to filing taxes, the e-file process has become increasingly popular due to its convenience and efficiency. In this detailed guide, we’ll explore the ins and outs of e-filing your taxes, ensuring you have a comprehensive understanding of the process.

What is E-File Tax?

E-file tax refers to the electronic filing of tax returns. It allows taxpayers to submit their tax information to the IRS or state tax agencies through the internet. This method is faster, more accurate, and often more cost-effective than traditional paper filing.

Benefits of E-File Tax

There are several benefits to e-filing your taxes:

| Benefit | Description |

|---|---|

| Speed | E-filed returns are processed much faster than paper returns, often within 24 hours. |

| Accuracy | Electronic filing reduces the likelihood of errors, such as math mistakes or missing information. |

| Convenience | Access your tax information from anywhere with an internet connection. |

| Security | Secure encryption ensures your tax information is protected during transmission. |

| Refund Speed | E-filed returns with direct deposit can receive refunds in as little as 21 days. |

Eligibility for E-File Tax

Most taxpayers are eligible to e-file their taxes. However, there are some exceptions:

- Individuals with an Adjusted Gross Income (AGI) of $72,000 or less can use free e-file services.

- Self-employed individuals, farmers, and those with complex tax situations may need to use paid software or a tax professional.

- Some taxpayers may be required to file paper returns due to specific tax situations or living abroad.

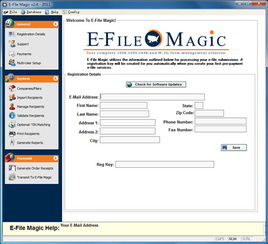

Choosing an E-File Service

There are several e-file services available, including:

- IRS Free File: Offers free tax preparation and e-filing for eligible taxpayers.

- Commercial Tax Software: Paid software options like TurboTax, H&R Block, and TaxAct provide comprehensive tax preparation and e-filing services.

- Online Tax Services: Websites like TaxAct Online and TaxSlayer offer affordable e-filing options.

When choosing an e-file service, consider factors such as cost, ease of use, customer support, and the ability to import previous year’s tax information.

Preparing Your Tax Return

Before e-filing your taxes, gather all necessary documents, such as W-2s, 1099s, and receipts for deductions. Follow these steps to prepare your tax return:

- Enter your personal information, including name, address, and Social Security number.

- Enter your income information, including wages, interest, dividends, and self-employment income.

- Claim deductions and credits, such as the standard deduction, child tax credit, and education credits.

- Review your tax return for accuracy and completeness.

Submitting Your Tax Return

Once your tax return is complete, follow these steps to submit your e-file:

- Select your preferred e-file service.

- Enter your payment information, if applicable.

- Review your tax return one last time.

- Submit your tax return and receive confirmation of successful e-filing.

Tracking Your Tax Return

After submitting your e-file, you can track the status of your tax return using the IRS’s “Where’s My Refund?” tool. This tool provides an estimated date for when your refund will be issued.

Common E-File Tax Issues

While e-filing is generally straightforward, some common issues may arise:

- Inaccurate information: Double-check your tax return for errors, such as incorrect Social Security numbers or income figures