How to File Extension for Taxes: A Comprehensive Guide

When it comes to filing taxes, there are times when you might find yourself needing an extension. Whether it’s due to unforeseen circumstances or simply needing more time to gather all the necessary documents, understanding how to file an extension is crucial. In this detailed guide, we’ll walk you through the process step by step, ensuring you’re well-prepared to file your extension on time.

Understanding Tax Extensions

A tax extension is essentially an extension of the deadline to file your tax return. It’s important to note that while an extension gives you more time to file, it does not extend the deadline for paying any taxes owed. If you owe taxes, you must estimate the amount you owe and pay it by the original filing deadline to avoid penalties and interest.

Eligibility for a Tax Extension

Most taxpayers are eligible for a tax extension. However, there are a few exceptions. For example, if you’re a resident of a U.S. possession, you may not be eligible for an extension. Additionally, if you’re a non-resident alien, you may have different rules and requirements for filing an extension.

How to File an Extension

Filing an extension is a straightforward process. Here’s how you can do it:

-

Use Form 4868: This form is used to request an automatic extension to file your tax return. You can file Form 4868 electronically or by mail.

-

File by Mail: If you prefer to file by mail, you can download Form 4868 from the IRS website and mail it to the appropriate IRS center. Make sure to include your Social Security number, filing status, and an estimate of your tax liability.

-

File Electronically: If you’re comfortable filing your taxes electronically, you can use tax preparation software or a tax professional to file Form 4868. Simply follow the prompts provided by the software or your tax professional.

-

Pay Any Taxes Owed: If you owe taxes, you must estimate the amount you owe and pay it by the original filing deadline. You can pay online, by phone, or by mail. Be sure to keep a record of your payment for your records.

Deadlines for Filing an Extension

The deadline to file an extension is the same as the deadline to file your tax return. For most taxpayers, this is April 15th. However, if April 15th falls on a weekend or a holiday, the deadline is extended to the next business day. It’s important to file your extension on time to avoid any late filing penalties.

Penalties for Late Filing

While an extension gives you more time to file your tax return, it does not give you more time to pay any taxes owed. If you fail to pay your taxes by the original filing deadline, you may be subject to penalties and interest. The penalty for failing to pay on time is typically 0.5% of the amount owed for each month or part of a month that the tax remains unpaid, up to a maximum of 25% of the tax owed.

Penalties for Late Filing Without Payment

If you fail to file your tax return by the original filing deadline, you may be subject to a late filing penalty. The penalty is typically 5% of the amount owed for each month or part of a month that the return is late, up to a maximum of 25% of the tax owed.

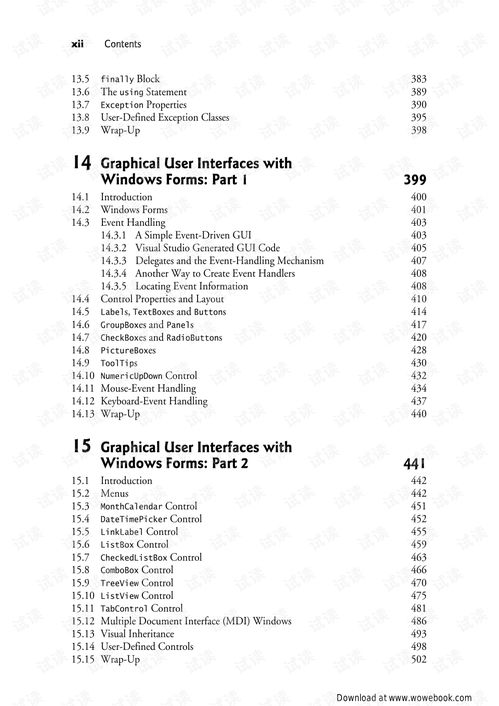

Table: Comparison of Penalties

| Penalty Type | Percentage of Tax Owed | Maximum Penalty |

|---|---|---|

| Late Payment Penalty | 0.5% per month | 25% |

| Late Filing Penalty | 5% per month | 25% |

How to Avoid Penalties

One of the best ways to avoid penalties is to file your tax return on time and pay any taxes owed by the original filing deadline. If you’re unable to file on time, be sure to file an extension to avoid the late filing penalty. And if you owe taxes,