How to File a Tax Return: A Comprehensive Guide

Understanding the process of filing a tax return can be daunting, especially if you’re new to it. However, with the right guidance, you can navigate through the process smoothly. This article will provide you with a detailed, step-by-step guide on how to file a tax return, ensuring that you are well-prepared and confident in your submission.

Choosing the Right Tax Filing Method

Before you start, it’s important to determine the best method for filing your tax return. There are several options available, each with its own set of advantages and disadvantages.

- Online Tax Filing: This is the most convenient and fastest way to file your taxes. You can use tax preparation software or a reputable online service to guide you through the process.

- Using a Tax Preparer: If you prefer a personal touch or have complex tax situations, hiring a tax preparer might be the best option. They can provide expert advice and ensure your return is accurate.

- Self-Filing: If you’re confident in your ability to navigate the tax code, you can file your taxes on your own. This can be done using paper forms or through the IRS website.

Consider your personal preferences, financial situation, and the complexity of your tax return when choosing the right filing method.

Gathering Necessary Documents

Before you begin the filing process, gather all the necessary documents to ensure a smooth experience. Here’s a list of common documents you’ll need:

- W-2 forms from all employers

- 1099 forms for any income other than wages

- Proof of any tax deductions or credits you plan to claim

- Bank account information for direct deposit of your refund

- Previous year’s tax return (if available)

Make sure to keep these documents organized and easily accessible throughout the filing process.

Understanding Tax Forms

There are several tax forms you may need to complete your return. Here’s a brief overview of some of the most common forms:

| Form | Description |

|---|---|

| Form 1040 | U.S. Individual Income Tax Return |

| Form 1040A | U.S. Individual Income Tax Return (Simplified) |

| Form 1040EZ | U.S. Individual Income Tax Return (Very Simple) |

| Form 1040X | Amended U.S. Individual Income Tax Return |

Each form has its own set of instructions and requirements. Be sure to carefully review the instructions for each form you need to complete.

Completing the Tax Return

Once you have gathered all the necessary documents and understand the forms, it’s time to start completing your tax return. Here’s a step-by-step guide to help you through the process:

- Enter your personal information: This includes your name, Social Security number, filing status, and address.

- Report your income: List all sources of income, such as wages, interest, dividends, and self-employment income.

- Claim deductions and credits: Review the tax deductions and credits you’re eligible for and enter the appropriate information.

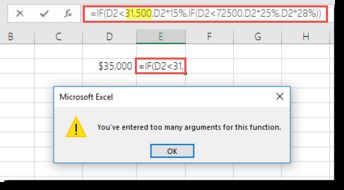

- Calculate your tax liability: Use the tax tables or tax software to determine how much tax you owe.

- Request a refund or pay any tax due: If you’re owed a refund, indicate how you’d like to receive it (e.g., direct deposit, check). If you owe taxes, make sure to pay the amount due by the deadline.

- Review your return: Double-check all the information you’ve entered to ensure accuracy.

- Sign and date your return: Both you and your spouse, if applicable, must sign and date the return.