Understanding the Process of Filing a Tax Return Extension

When it comes to tax season, many individuals and businesses find themselves in need of an extension to file their tax returns. This is a common scenario, and understanding the process of filing a tax return extension can help alleviate some of the stress that comes with tax obligations. In this article, we will delve into the details of how to file a tax return extension, the benefits of doing so, and the potential consequences if you fail to file on time.

What is a Tax Return Extension?

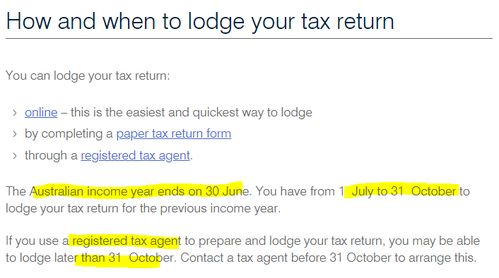

A tax return extension is an official request to the IRS to delay the deadline for filing your tax return. The standard deadline for filing individual tax returns is April 15th, but you can request an automatic six-month extension, pushing the deadline to October 15th. This extension is granted automatically if you file it on time, without needing to provide any additional information or justification.

How to File a Tax Return Extension

Filing a tax return extension is a straightforward process. Here are the steps you need to follow:

-

Use Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form is available on the IRS website or through tax preparation software.

-

Fill out the form with your personal information, including your name, Social Security number, and filing status.

-

Calculate the amount of tax you owe and include a check or money order for the estimated amount due, if applicable. You can also pay online using a credit card or electronic funds withdrawal.

-

Sign and date the form.

-

Mail the completed form and payment (if applicable) to the IRS center for your state by the April 15th deadline.

It’s important to note that while the extension to file is automatic, any tax owed must be paid by the original deadline to avoid penalties and interest.

Benefits of Filing a Tax Return Extension

There are several benefits to filing a tax return extension:

-

Extra Time to Gather Information: An extension gives you more time to gather all the necessary information to complete your tax return accurately.

-

Reduced Risk of Penalties: By filing an extension, you can avoid late filing penalties, which can be substantial.

-

Peace of Mind: Knowing that you have more time to file your tax return can reduce stress and help you focus on other important tasks.

Consequences of Not Filing a Tax Return Extension

While filing an extension is a simple process, failing to file one can have serious consequences:

-

Late Filing Penalties: If you fail to file your tax return by the April 15th deadline, you may be subject to a late filing penalty of 5% of the tax owed for each month, up to a maximum of 25%.

-

Interest on Unpaid Taxes: If you owe taxes and fail to pay them by the April 15th deadline, you will be charged interest on the unpaid balance.

-

Loss of Refund: If you are owed a refund, failing to file your tax return by the deadline may result in the IRS keeping your refund.

Table: IRS Penalties for Late Filing and Late Payment

| Penalty Type | Percentage of Tax Owed | Maximum Penalty |

|---|---|---|

| Late Filing Penalty | 5% per month (up to 25%) | 25% |

| Late Payment Penalty | 0.5% per month (up to 25%) | 25% |

Understanding the penalties for late filing and late payment can help you prioritize your tax obligations and ensure that you file your tax return extension on time.

Additional Tips for Filing a Tax Return Extension

Here are some additional tips to help you navigate the process of filing a tax return extension: