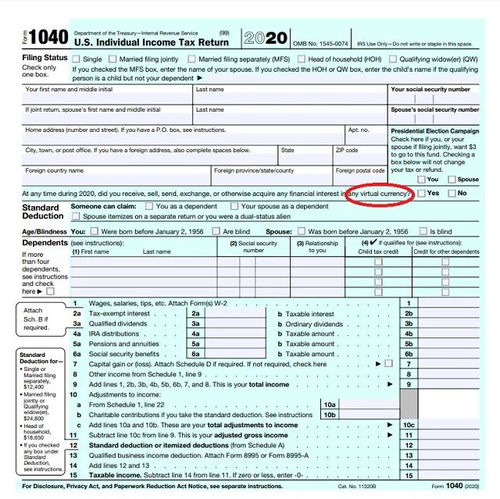

Understanding the IRS Form 1040

Are you preparing to file your IRS Form 1040 for the 2022 tax year? If so, you’re not alone. This form is a cornerstone of the United States tax system, and understanding it can make the process smoother and more efficient. Let’s delve into the details of the Form 1040, its sections, and what you need to know to file it correctly.

What is Form 1040?

Form 1040 is the standard individual income tax return form used by residents of the United States to file their federal income taxes. It’s designed to cover a wide range of income types, deductions, and credits. The form has been around since 1913 and has evolved over the years to accommodate changes in tax laws and economic conditions.

Form 1040 Overview

Here’s a brief overview of the Form 1040, broken down into its main sections:

| Section | Description |

|---|---|

| Form 1040 | The main form where you enter your personal information, filing status, and total income. |

| Schedule 1 | Used to report additional income, adjustments to income, and tax credits. |

| Schedule A | Used to report itemized deductions, such as medical expenses, mortgage interest, and charitable contributions. |

| Schedule B | Used to report interest and dividends received. |

| Schedule C | Used to report business income or loss. |

| Schedule D | Used to report capital gains and losses. |

| Schedule E | Used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, and trusts. |

| Schedule R | Used to report retirement plan distributions. |

| Schedule SE | Used to report self-employment tax. |

Personal Information and Filing Status

When you start filling out Form 1040, you’ll begin with your personal information. This includes your name, Social Security number, and filing status. Your filing status can be married filing jointly, married filing separately, head of household, qualifying widow(er) with dependent child, single, or married filing separately (if you lived apart from your spouse for the entire year).

Reporting Income

The next step is to report your income. This includes wages, salaries, tips, taxable scholarships, and other types of income. You’ll need to enter the total amount of income you received from each source and any tax withheld.

Adjustments to Income

After reporting your income, you may be eligible for adjustments to income. These are deductions that you can take without itemizing. Common adjustments include student loan interest, IRA contributions, and self-employment tax.

Itemized Deductions

Itemized deductions are another way to reduce your taxable income. You can choose to take the standard deduction or itemize your deductions. Common itemized deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions.

Tax Credits

Tax credits are a valuable way to reduce your tax liability. They are different from deductions because they directly reduce the amount of tax you owe. Common tax credits include the Earned Income Tax Credit, Child Tax Credit, and American Opportunity Tax Credit.

Calculating Tax and Refunds

Once you’ve completed all the necessary sections, you’ll calculate your tax liability. This is done by applying your tax rate to your taxable income. If you owe tax, you’ll need to pay it by the filing deadline. If you’re owed a refund, you’ll receive it after you file your return.

Where to File

There are several ways to file your Form 1040. You can file it online, through a