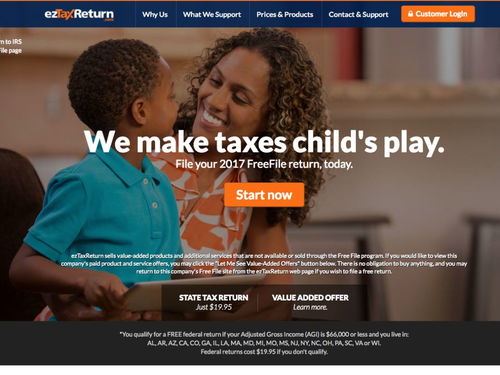

Understanding File-Free IRS: A Comprehensive Guide

Are you tired of the绻佺悙 process of filing taxes? Do you wish there was a simpler, more efficient way to handle your tax obligations? Look no further! File-Free IRS is here to revolutionize the way you file your taxes. In this detailed guide, we will explore the ins and outs of File-Free IRS, its benefits, how it works, and much more. Get ready to simplify your tax filing experience!

What is File-Free IRS?

File-Free IRS is an innovative online tax filing service designed to make the tax filing process as easy and stress-free as possible. It eliminates the need for paper forms and physical filing, allowing you to submit your taxes electronically in a matter of minutes. By using File-Free IRS, you can save time, reduce errors, and enjoy peace of mind knowing that your taxes are in good hands.

Benefits of Using File-Free IRS

There are numerous benefits to using File-Free IRS for your tax filing needs. Here are some of the key advantages:

-

Time-saving: With File-Free IRS, you can file your taxes in a fraction of the time it would take to complete paper forms and visit an IRS office.

-

Error reduction: The software helps minimize errors by guiding you through the tax filing process and automatically calculating your taxes.

-

Accessibility: File-Free IRS is available 24/7, allowing you to file your taxes at your convenience, from anywhere in the world.

-

Security: The service employs advanced encryption and security measures to protect your personal and financial information.

-

Free filing options: Depending on your income and filing status, you may be eligible for free tax filing services through File-Free IRS.

How Does File-Free IRS Work?

Using File-Free IRS is a straightforward process. Here’s a step-by-step guide to help you get started:

-

Sign up for an account: Visit the File-Free IRS website and create an account by providing your basic information.

-

Enter your tax information: Fill out the required tax forms and enter your income, deductions, and credits. The software will guide you through each step, ensuring accuracy.

-

Review and submit: Once you’ve entered all the necessary information, review your tax return for any errors or omissions. If everything looks good, submit your return electronically.

-

Track your return: After submitting your return, you can track its status online. You’ll receive an email notification once your return has been processed.

Eligibility and Requirements

Not everyone is eligible to use File-Free IRS. Here are the main requirements:

-

U.S. resident: You must be a U.S. resident or citizen to use File-Free IRS.

-

Income limits: The service is available for individuals with an adjusted gross income (AGI) of $66,000 or less.

-

Valid identification: You’ll need a valid Social Security number or Individual Taxpayer Identification Number (ITIN) to file your taxes.

Comparing File-Free IRS with Other Tax Filing Methods

When it comes to tax filing, there are several options available, including traditional paper filing, tax software, and professional tax preparers. Here’s a comparison of File-Free IRS with these methods: