Understanding Tax Act Free File: A Comprehensive Guide for You

Are you looking for a hassle-free way to file your taxes? Tax Act Free File might just be the solution you need. In this detailed guide, we’ll explore what Tax Act Free File is, how it works, its benefits, and how you can make the most out of it. Let’s dive in!

What is Tax Act Free File?

Tax Act Free File is an online tax preparation service offered by Tax Act, a leading tax preparation software provider. It allows individuals and families to file their federal and state taxes for free, making it an attractive option for those who qualify.

How Does Tax Act Free File Work?

Using Tax Act Free File is a straightforward process. Here’s a step-by-step guide:

- Visit the Tax Act website and click on the “Free File” option.

- Select your filing status, such as single, married filing jointly, or head of household.

- Enter your personal information, including your Social Security number and filing status.

- Answer a series of questions about your income, deductions, and credits.

- Review your tax return and submit it online.

It’s important to note that Tax Act Free File is only available to eligible taxpayers. To qualify, you must have an adjusted gross income (AGI) of $66,000 or less for the tax year 2022.

Benefits of Tax Act Free File

There are several benefits to using Tax Act Free File:

- Free Tax Preparation: As the name suggests, Tax Act Free File offers free tax preparation services to eligible taxpayers.

- Accuracy: Tax Act uses advanced algorithms to ensure your tax return is accurate and error-free.

- Security: Tax Act employs robust security measures to protect your personal and financial information.

- Expert Support: Tax Act provides customer support to assist you with any questions or issues you may encounter during the filing process.

Eligibility for Tax Act Free File

Not everyone is eligible to use Tax Act Free File. Here are the criteria you must meet:

- Income Limit: Your AGI must be $66,000 or less for the tax year 2022.

- Residency: You must be a resident of the United States.

- Age: You must be at least 18 years old or have a parent or guardian who signs the tax return.

How to Make the Most Out of Tax Act Free File

Here are some tips to help you make the most out of Tax Act Free File:

- Organize Your Documents: Gather all necessary tax documents, such as W-2s, 1099s, and receipts for deductions and credits.

- Stay Informed: Keep up with the latest tax laws and changes to ensure you’re taking advantage of all available deductions and credits.

- Review Your Return: Carefully review your tax return before submitting it to ensure accuracy.

- Keep Copies: Keep a copy of your tax return and supporting documents for your records.

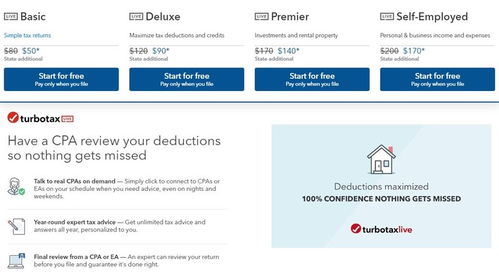

Comparing Tax Act Free File with Other Free Tax Filing Options

While Tax Act Free File is a great option for many taxpayers, it’s important to consider other free tax filing services available: