How to File an Insurance Claim Against Another Driver

Accidents happen, and when they do, it’s important to know how to navigate the process of filing an insurance claim against the other driver. This guide will walk you through the steps, from gathering evidence to submitting your claim, to ensure you receive the compensation you deserve.

Understanding the Basics

Before you start the process, it’s crucial to understand the basics. An insurance claim is a formal request to your insurance company for compensation for damages or injuries sustained in an accident. When filing a claim against another driver, you’ll need to prove that the other driver was at fault.

Gathering Evidence

After an accident, it’s essential to gather as much evidence as possible. Here’s what you should do:

-

Take photographs of the accident scene, including the vehicles involved, any visible damage, and the surrounding area.

-

Exchange information with the other driver, including their name, contact information, and insurance details.

-

Get the names and contact information of any witnesses.

-

Seek medical attention if you or anyone else is injured.

-

Report the accident to the police, especially if there are injuries or significant property damage.

Documenting the Incident

Documenting the incident is crucial for your claim. Here’s what you should include:

-

Date and time of the accident.

-

Location of the accident.

-

Weather and road conditions at the time of the accident.

-

Description of how the accident occurred.

-

Names and contact information of all parties involved.

-

Insurance information of all parties involved.

Reporting the Accident to Your Insurance Company

Once you have gathered all the necessary information and documentation, report the accident to your insurance company as soon as possible. Here’s what you should do:

-

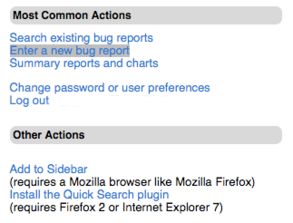

Contact your insurance company by phone or online.

-

Provide them with the details of the accident and any evidence you have gathered.

-

Follow any instructions provided by your insurance company.

Filing a Claim Against the Other Driver

After reporting the accident to your insurance company, you may need to file a claim against the other driver. Here’s how to do it:

-

Notify the other driver’s insurance company of the claim.

-

Provide them with the same information and evidence you provided to your insurance company.

-

Cooperate with the other driver’s insurance company during the investigation.

Understanding the Claims Process

The claims process can vary depending on your insurance company and the specifics of the accident. Here’s what you can expect:

-

Investigation: Your insurance company and the other driver’s insurance company will investigate the accident to determine fault.

-

Valuation: The insurance companies will assess the damage to your vehicle and any other property involved.

-

Compensation: Once fault is determined and the damage is assessed, the insurance companies will negotiate a settlement.

Dealing with Insurance Adjusters

During the claims process, you may interact with insurance adjusters. Here are some tips for dealing with them:

-

Be honest and provide accurate information.

-

Don’t admit fault or apologize for the accident.

-

Ask questions and seek clarification if needed.

-

Keep detailed records of all communications with the adjusters.

Seeking Legal Assistance

If you encounter difficulties or disputes during the claims process, consider seeking legal assistance. An attorney can help you navigate the complexities of insurance claims and ensure you receive fair compensation.