File Taxes with IRS: A Comprehensive Guide for Individuals

Understanding the process of filing taxes with the Internal Revenue Service (IRS) can be daunting, especially for those who are new to the process. Whether you’re a student, a small business owner, or a seasoned professional, knowing how to navigate the IRS’s tax filing system is crucial. This guide will provide you with a detailed overview of the steps involved in filing taxes with the IRS, ensuring that you are well-prepared for the tax season.

Choosing the Right Tax Filing Status

Your tax filing status determines how much you’ll owe in taxes and the tax credits and deductions you may be eligible for. The IRS offers five filing statuses: Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child. It’s important to choose the status that best reflects your situation.

| Filing Status | Description |

|---|---|

| Single | For individuals who are not married, legally separated, or widowed. |

| Married Filing Jointly | For married couples who choose to file a joint tax return. |

| Married Filing Separately | For married couples who choose to file separate tax returns. |

| Head of Household | For individuals who are unmarried, have a dependent child, and paid more than half the cost of keeping up a home for the child. |

| Qualifying Widow(er) with Dependent Child | For widows or widowers who have a dependent child and have not remarried. |

Collecting Necessary Documents

Before you begin the tax filing process, gather all the necessary documents to ensure a smooth and accurate filing. These documents typically include:

- W-2 forms from employers

- 1099 forms for income from investments, interest, and other sources

- Proof of any tax credits or deductions you may be eligible for

- Bank account information for direct deposit of your refund

Choosing a Tax Filing Method

There are several ways to file your taxes with the IRS, each with its own advantages and disadvantages:

- Online Tax Filing: Using online tax preparation software or a tax filing service can be convenient and often more accurate. Many services offer free filing for individuals with a simple tax return.

- Self-Filing: If you’re comfortable with tax laws and forms, you can file your taxes yourself using IRS forms and instructions. This method can be time-consuming and may require research to ensure accuracy.

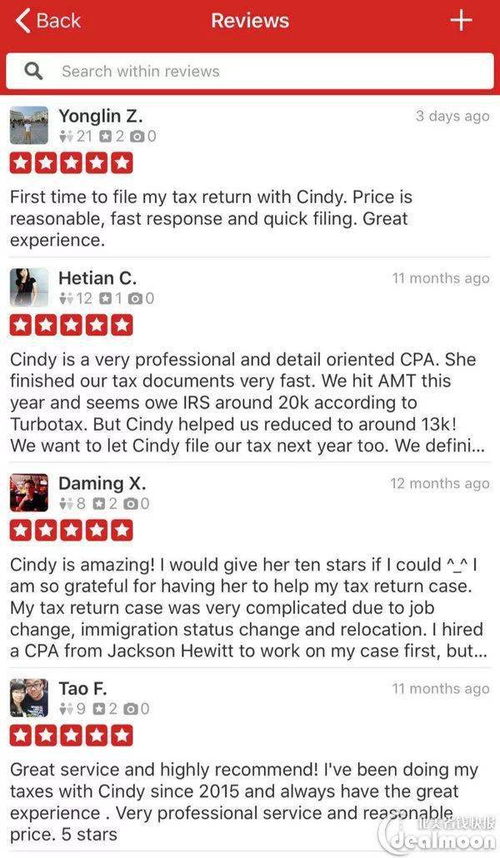

- Using a Tax Professional: A certified public accountant (CPA), enrolled agent (EA), or tax attorney can help you navigate complex tax situations and ensure that your return is accurate.

Filing Your Tax Return

Once you’ve chosen your filing method, follow these steps to file your tax return:

- Enter your personal information, including your name, Social Security number, and filing status.

- Enter your income information, including wages, interest, dividends, and other sources of income.

- Claim any tax credits and deductions you’re eligible for.

- Calculate your tax liability and any refund you may be owed.

- Review your return for accuracy and completeness.

- E-file your return or mail it to the IRS, depending on your chosen filing method.

Understanding Tax Refunds and Penalties

One of the most common questions about filing taxes is whether you’ll receive a refund. Here’s what you need to know:

- Tax Refunds: If you overpaid your taxes, you’ll receive a refund. The IRS typically issues refunds within 21 days of receiving your e-filed return or 6-8 weeks for a paper return.

- Tax Penalties: