Understanding the Tax Deadline to File: A Comprehensive Guide for You

As the tax season approaches, many individuals and businesses find themselves grappling with the complexities of tax filing. One of the most crucial aspects of this process is understanding the tax deadline to file. This guide is designed to provide you with a detailed and multi-dimensional introduction to the tax deadline, ensuring that you are well-prepared for the upcoming filing season.

What is the Tax Deadline to File?

The tax deadline to file refers to the specific date by which individuals and businesses must submit their tax returns to the relevant tax authorities. This deadline is set by the government and varies depending on the country and the type of tax return being filed.

United States: Tax Deadline to File

In the United States, the standard tax deadline to file is April 15th. However, this date can be extended in certain circumstances. For example, if the 15th falls on a weekend or a federal holiday, the deadline is automatically pushed to the following Monday. Additionally, individuals and businesses who live in areas affected by natural disasters may be granted an extension.

Here is a breakdown of the tax deadline to file in the United States:

| Standard Tax Deadline | Extended Tax Deadline |

|---|---|

| April 15th | April 18th (if April 15th falls on a weekend or federal holiday) |

| October 15th | October 17th (if October 15th falls on a weekend or federal holiday) |

Canada: Tax Deadline to File

In Canada, the tax deadline to file is April 30th for individuals and April 30th or June 15th for corporations, depending on the fiscal year-end. If April 30th falls on a weekend or a statutory holiday, the deadline is automatically pushed to the following Monday.

United Kingdom: Tax Deadline to File

In the United Kingdom, the tax deadline to file is October 31st for self-assessment tax returns. However, individuals who file their tax returns online can request an extension until January 31st of the following year.

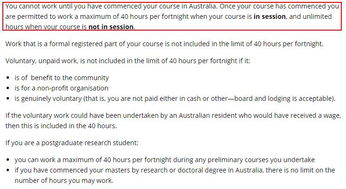

Australia: Tax Deadline to File

In Australia, the tax deadline to file is October 31st for individuals and businesses. However, individuals who are self-employed or have a trust or partnership may have a different deadline, depending on their specific circumstances.

How to Determine Your Tax Deadline to File

Understanding your tax deadline to file is essential to avoid penalties and interest. Here are some steps to help you determine your tax deadline:

- Check the tax authority’s website for the specific deadline for your country and type of tax return.

- Consider any extensions or deadlines that may apply to your situation, such as natural disasters or fiscal year-end.

- Keep track of any changes to the tax deadline, as these can occur due to various factors, including holidays and natural disasters.

Consequences of Missing the Tax Deadline to File

Missing the tax deadline to file can have serious consequences, including penalties and interest. Here are some of the potential consequences:

- Penalties: You may be subject to penalties for late filing, which can vary depending on the country and the severity of the delay.

- Interest: If you owe taxes, you may be charged interest on the amount owed, which can accumulate over time.

- Enforcement Actions: In some cases, the tax authority may take enforcement actions, such as levying your bank account or placing a lien on your property.

Preparing for the Tax Deadline to File

Preparing for the tax deadline to file involves several steps, including gathering necessary documents, organizing your financial records, and ensuring that you have all the information needed to complete your tax return. Here are some tips to help you prepare:

- Gather Necessary Documents: Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions and credits.

- Organize Your Financial Records: Keep your financial records organized and easily accessible, so you