E File Tax Return: A Comprehensive Guide for You

Understanding the process of e-filing your tax return can be a daunting task, especially if you’re new to the concept. But fear not, as this guide will walk you through the ins and outs of e-filing your tax return, ensuring a smooth and hassle-free experience. Whether you’re a seasoned tax filer or a first-timer, this article will provide you with all the information you need to successfully e-file your tax return.

What is E-File Tax Return?

E-filing your tax return refers to the process of submitting your tax return electronically to the IRS (Internal Revenue Service) or your local tax authority. This method has gained immense popularity due to its convenience, speed, and accuracy. By e-filing, you can save time, reduce errors, and receive your refund faster than traditional paper filing.

Benefits of E-File Tax Return

There are several benefits to e-filing your tax return:

| Benefits | Description |

|---|---|

| Convenience | Access your tax return from anywhere, anytime, as long as you have an internet connection. |

| Speed | Get your refund in as little as 21 days, compared to 6-8 weeks for paper filing. |

| Accuracy | Reduce errors by using tax software that guides you through the process and checks for mistakes. |

| Security | Ensure your sensitive information is protected with secure encryption and authentication. |

How to E-File Your Tax Return

Follow these steps to e-file your tax return:

-

Choose a tax preparation software or a tax professional to help you with your tax return.

-

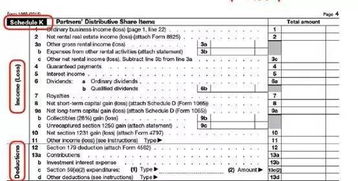

Collect all necessary documents, such as W-2s, 1099s, and other tax forms.

-

Enter your personal information, income, deductions, and credits into the tax software.

-

Review your tax return for accuracy and completeness.

-

Sign and submit your tax return electronically.

-

Track the status of your tax return and refund online.

Popular E-File Tax Software

Several tax software options are available to help you e-file your tax return. Here are some popular choices:

-

Intuit TurboTax

-

H&R Block

-

TaxAct

-

FreeFile

Common E-File Tax Return Mistakes

While e-filing your tax return is generally straightforward, there are some common mistakes to avoid:

-

Misentering personal information

-

Not reviewing your tax return for errors

-

Not double-checking your tax forms

-

Not keeping copies of your tax return and supporting documents

When to E-File Your Tax Return

The IRS accepts e-filed tax returns starting on January 24th of each year. It’s recommended to e-file your tax return as soon as possible to ensure you receive your refund in a timely manner. However, you can e-file your tax return up until the tax deadline, which is April 15th (April 18th in 2023 due to Emancipation Day in Washington, D.C.).

Conclusion

E-filing your tax return is a convenient, accurate, and secure way to submit your tax return. By following this guide, you can ensure a smooth and successful e-filing experience. Remember to choose a reliable tax software or professional, gather all necessary documents, and double-check your tax return for accuracy. Happy e-filing!