Understanding the Process of Filing for Homestead Exemption

Are you a homeowner looking to save on property taxes? Filing for a homestead exemption might be the answer. This article will guide you through the process of filing for a homestead exemption, providing you with a comprehensive understanding of the benefits, eligibility criteria, and the necessary steps to take.

What is a Homestead Exemption?

A homestead exemption is a property tax reduction available to homeowners who live in their primary residence. It is designed to provide financial relief to homeowners, particularly those who are retired or have fixed incomes. The amount of the exemption varies by state, but it typically reduces the taxable value of your property, thereby lowering your property tax bill.

Benefits of Filing for Homestead Exemption

There are several benefits to filing for a homestead exemption:

-

Lower property taxes: The most obvious benefit is the reduction in your property tax bill.

-

Financial relief: For many homeowners, especially those on fixed incomes, the reduction in property taxes can provide significant financial relief.

-

Preservation of equity: By reducing the taxable value of your property, you can preserve more of your home’s equity.

Eligibility Criteria

Eligibility for a homestead exemption varies by state, but here are some common criteria:

-

Primary residence: You must live in the property as your primary residence.

-

Ownership: You must own the property.

-

Residency: You must be a resident of the state where you are applying for the exemption.

-

Age requirement: Some states have age requirements, typically for homeowners over the age of 65 or disabled veterans.

How to File for Homestead Exemption

Filing for a homestead exemption typically involves the following steps:

-

Research your state’s requirements: Each state has its own rules and procedures for filing for a homestead exemption. Visit your state’s tax or revenue department website to gather the necessary information.

-

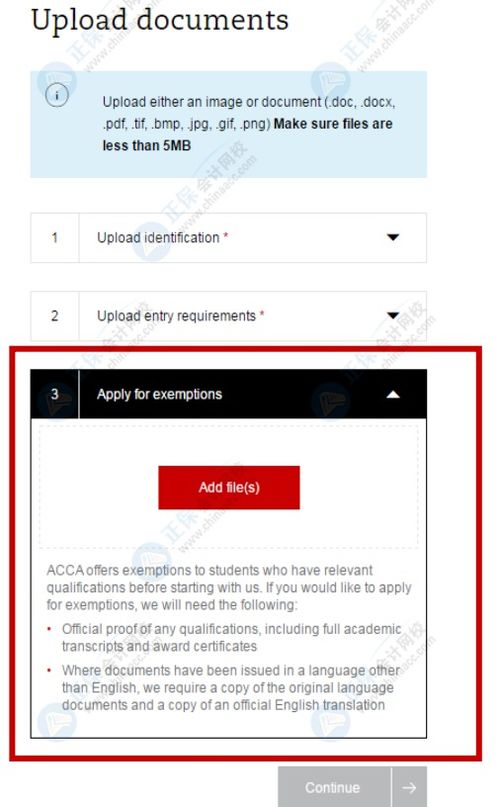

Collect required documents: You will likely need to provide proof of ownership, residency, and sometimes proof of age or disability. Gather these documents before you begin the filing process.

-

Complete the application: The application form can usually be found on your state’s tax or revenue department website. Fill out the form accurately and completely.

-

Submit the application: Submit the completed application and any required documents to your local tax assessor’s office. Some states allow you to file online or by mail.

-

Wait for approval: Once your application is submitted, the tax assessor’s office will review it. You may receive a confirmation letter or notification of approval. If you are approved, your property tax bill will be adjusted accordingly.

Common Questions About Homestead Exemptions

Here are some common questions about homestead exemptions:

-

Can I file for a homestead exemption if I rent my property?

No, you must own the property to be eligible for a homestead exemption.

-

Can I have more than one homestead exemption?

No, you can only have one homestead exemption per property.

-

Do I need to re-file for a homestead exemption every year?

No, once you have been granted a homestead exemption, it typically remains in effect as long as you continue to live in the property as your primary residence.

Conclusion

Filing for a homestead exemption can be a valuable way to reduce your property taxes and provide financial relief. By understanding the eligibility criteria, the filing process, and the benefits of a homestead exemption, you can make an informed decision about whether to apply for this tax reduction.

| State | Homestead Exemption Amount | Eligibility Requirements |

|---|---|---|