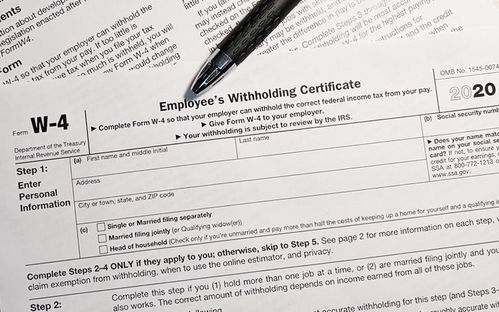

Understanding the IRS Tax Extension: A Comprehensive Guide for You

When it comes to filing taxes, the IRS offers a valuable tool known as the tax extension. This guide will delve into the details of what a tax extension is, how to apply for one, and the benefits it provides. Whether you’re a seasoned tax filer or new to the process, this information will help you navigate the complexities of tax extensions.

What is an IRS Tax Extension?

An IRS tax extension is an extension of the time you have to file your tax return. It is not an extension of the time to pay your taxes. By filing for an extension, you gain an additional six months to file your tax return, giving you more time to gather necessary documents and ensure accuracy.

Who Can Apply for an IRS Tax Extension?

Almost anyone who needs more time to file their tax return can apply for an IRS tax extension. This includes individuals, partnerships, corporations, estates, and trusts. However, there are some exceptions, such as estates and trusts that are required to file an estate tax return.

How to Apply for an IRS Tax Extension

Applying for an IRS tax extension is a straightforward process. Here are the steps you need to follow:

-

File Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, with the IRS by the original filing deadline.

-

For partnerships, file Form 7004, Application for Automatic Extension of Time to File and Pay U.S. Income Tax, by the original filing deadline.

-

For corporations, file Form 7004, Application for Automatic Extension of Time to File Corporation Income Tax Return, by the original filing deadline.

-

For estates and trusts, file Form 8828, Application for Extension of Time to File an Estate or Trust Income Tax Return, by the original filing deadline.

It’s important to note that while you can file for an extension electronically, you must still pay any taxes owed by the original filing deadline to avoid penalties and interest.

Benefits of an IRS Tax Extension

There are several benefits to filing for an IRS tax extension:

-

Extra Time to File: The most obvious benefit is the additional six months to file your tax return. This can be particularly helpful if you’re waiting for documents from a financial institution or if you need more time to gather information.

-

Avoid Penalties: By filing for an extension, you can avoid the late filing penalty, which is typically 5% of the tax owed for each month you’re late, up to a maximum of 25%.

-

Peace of Mind: Knowing that you have more time to file your tax return can reduce stress and help you ensure that your return is accurate.

Understanding the Tax Extension Payment

While an IRS tax extension gives you more time to file your return, it does not give you more time to pay your taxes. You must estimate and pay any taxes owed by the original filing deadline to avoid penalties and interest. Here’s how to handle the tax extension payment:

-

Estimate Your Taxes: Use your best judgment to estimate the amount of tax you owe. You can use last year’s tax return as a starting point or consult with a tax professional.

-

Make the Payment: Pay the estimated amount by the original filing deadline. You can make the payment online, by phone, or by mail.

-

File Your Tax Return: Once you have the necessary information, file your tax return within the extended deadline.

Common Questions About IRS Tax Extensions

Here are some common questions about IRS tax extensions:

-

Can I file for an extension if I haven’t received all my tax documents?

Yes, you can file for an extension even if you haven’t received all your tax documents. Just estimate the amount of tax you owe and pay that amount by the original filing deadline.

-

Do I need to file an extension if I’m self-employed?

No