How to File 1099 Online: A Comprehensive Guide

Submitting 1099 forms can be a daunting task, especially if you’re new to the process. However, with the advent of online filing, it has become much easier and more convenient. In this guide, I’ll walk you through the steps to file 1099 online, ensuring you’re well-prepared and confident in your submission.

Understanding the Basics of 1099 Forms

Before diving into the online filing process, it’s essential to understand what 1099 forms are and why they are important. A 1099 form is a tax document used to report various types of income that are not subject to withholding taxes. These forms are typically issued to individuals or businesses who have earned income from sources other than employment, such as self-employment, rental income, or dividends.

There are several different types of 1099 forms, including:

| Form | Description |

|---|---|

| 1099-MISC | Reported to individuals or businesses for various types of payments, such as services, rent, or prizes. |

| 1099-INT | Reported to individuals for interest income from savings accounts, bonds, or other financial instruments. |

| 1099-DIV | Reported to individuals for dividends received from stocks or mutual funds. |

| 1099-R | Reported to individuals for distributions from retirement plans, annuities, or other retirement-related accounts. |

Choosing the Right Online Filing Service

There are several online services available to help you file 1099 forms. It’s important to choose a reputable and reliable service that meets your specific needs. Here are some factors to consider when selecting an online filing service:

- Accuracy and Reliability: Ensure the service has a strong track record of accurate and timely submissions.

- Compliance: The service should be up-to-date with the latest tax regulations and requirements.

- Ease of Use: Look for a service with an intuitive interface and user-friendly features.

- Customer Support: Choose a service that offers reliable customer support, in case you encounter any issues during the filing process.

Collecting Required Information

Before you begin the online filing process, gather all the necessary information. This includes:

- Recipient Information: Name, address, and Tax Identification Number (TIN) for each recipient.

- Payment Information: The amount paid to each recipient, as well as the date of each payment.

- Form Type: Determine the appropriate 1099 form for each type of payment.

Accessing the Online Filing Service

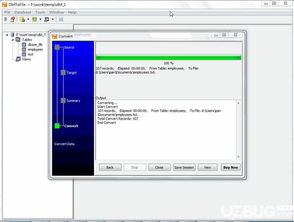

Once you’ve chosen an online filing service and collected all the necessary information, follow these steps to access the service:

- Sign Up: Create an account with the online filing service.

- Log In: Access your account using your username and password.

- Enter Recipient Information: Input the recipient’s name, address, and TIN.

- Enter Payment Information: Enter the amount paid to each recipient and the date of each payment.

- Select Form Type: Choose the appropriate 1099 form for each type of payment.

- Review and Submit: Double-check all the information for accuracy and submit your forms.

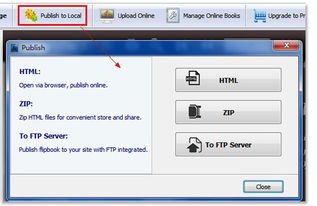

Printing and Distributing Copies

After submitting your 1099 forms online, you’ll need to print and distribute copies to the recipients. Here’s what you need to do:

- Print Copies: Print out the completed 1099 forms and any necessary attachments.

- Mail Copies: Mail copies of the 1099 forms to each recipient by January